Capital Credits

Do we owe you money?

Capital Credits

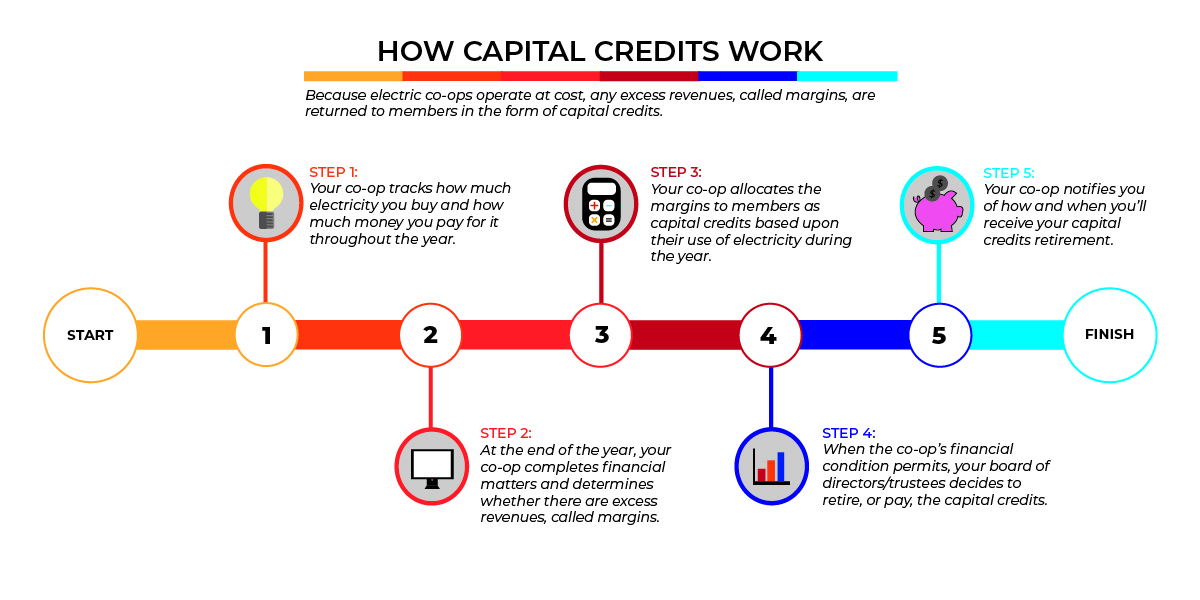

San Isabel Electric is a not-for-profit cooperative electric utility, meaning we operate at cost. We give any money that wasn’t used for running the business or saving for emergencies back to you. We call that unused money capital credit. When it’s financially safe to do so, the Board of Directors retires (returns) capital credits to members. Members receive their share as a check right in their mailbox. If you receive a capital credit check, it reflects your share of the unused money, or capital credit, based on the amount of electricity you used during the years of the capital credit retirement.

Stay in touch

Have you recently moved?

Unclaimed capital credits are typically not claimed due to incorrect contact information.

Because payments continue to be made many years after credits are earned, you should ensure that San Isabel Electric always has your current mailing address.

Please email us with your name and updated address to capitalcredits@siea.com or contact our office at (800) 279-7432 and ask for the Capital Credits department.

Unclaimed Capital Credit Search

Now, searching and claiming your capital credits is quick and easy. Former and current San Isabel Electric members should use this free service to check if we owe capital credits to you or one of your family members.

- Enter your first or last name into the search field and you will see the table filter automatically.

- If you find your name that means we owe you capital credits. Next, click the “Start My Claim” button to fill out an online form.

- A representative will contact you within a few weeks after you have submitted your online form.

- Last but not least, wait for your check! You will receive a check in the mail and your name will be removed from our searchable online database in approximately 30-45 days if we are able to verify your claim.

You can also start your claim by calling (800) 279-SIEA (7432) or by e-mailing capitalcredits@siea.com. You will be required to provide proof of identity before claiming capital credits.

NAME |

|---|

| 2205 POPE VALLEY PROPERTIES |

| A & B RADIATOR LLC |

| A & K REPAIR |

| A 1 AUTO SERVICE |

| A T & T COMMUNICATIONS |

| AANONSEN, TONI |

| AAROE, AIMEE |

| AB CO LLC |

| ABBRECHT, BRIAN |

| ABEL, GREG |

| ABELL, BETTY B |

| ABERNATHY, FRED E |

| ABEYTA, ANDREW A |

| ABEYTA, BENJAMIN G |

| ABEYTA, BETTY |

| ABEYTA, CONNIE |

| ABEYTA, FRANK M |

| ABEYTA, KEITH J |

| ABEYTA, MICHAEL J |

| ABEYTA, MONICA C |

| ABEYTA, SARAH |

| ABILA, IDA D |

| ABILA, ISAAC E |

| ABILA, IVAN P |

| ABPLANALP, PAUL |

| ABRAHAMSON, ROBERT |

| ACAR, TIZOC |

| ACKERMAN, SHERI A |

| ACORN CONSTRUCTION CO |

| ACOSTA, DAVIS OLGA |

| ACUFF, KEITH L |

| ACUFF, SHAYNA M |

| ADAIR, RAYMOND |

| ADAMS, AARON R |

| ADAMS, ALVA BJR |

| ADAMS, BARRY |

| ADAMS, CHRISTOPHER |

| ADAMS, DARRELL E |

| ADAMS, DAVID A |

| ADAMS, JACK W |

| ADAMS, JEREMY C |

| ADAMS, KEITH W |

| ADAMS, LINDSEY |

| ADAMS, LONI E |

| ADAMS, OLIVER W |

| ADAMS, ROBERT H |

| ADAMS, RUTH W |

| ADAMS, SHARON |

| ADAMS, V K |

| ADAMS, WILLIAM M |

| ADDINGTON, ORPHA M |

| ADKINS-NULL, DEBRA K |

| ADKISON, TIM |

| ADLER, MARISSA R |

| AGER, RAEANN |

| AGGEN, MYRA |

| AGUILAR, DRUG |

| AGUILAR, FRANK A |

| AGUILAR RECREATION CENTER |

| AGUILAR, ROGELIO |

| AGUILAR TV CLUB |

| AGUIRRE, ANNA |

| AGUIRRE, ARTHUR |

| AGUIRRE, BERTHA |

| AGUIRRE, CALVIN J |

| AGUIRRE, DOROTHY L |

| AGUIRRE, EDWARD S |

| AGUIRRE, EMILIE G |

| AGUIRRE, FRANKLIN A |

| AGUIRRE, GUILLERMINA |

| AGUIRRE, HUBERT B |

| AGUIRRE, JOSEPHINE M |

| AGUIRRE, LAWRENCE |

| AGUIRRE, MIKE |

| AGUIRRE, PORFIRIO |

| AGUIRRE, PORFIRIO JR |

| AHO, KATHY M |

| AHRENS, JEREMY J |

| AIKEN, ELIZABETH M |

| AIKEN, HILE |

| AKEY, IVAN D |

| AKHTAR, NASIM |

| AKINS, BOBBY E |

| ALBANESE, ERMA |

| ALBEE, MICHAEL L |

| ALBERS, JOSHUA J |

| ALBIN, DON |

| ALBO, CAROL |

| ALBO, CAROL J |

| ALBRINK, KARL |

| ALBRITTON, ROY S |

| ALDERMAN, SCOTT |

| ALDRED, PATRICIA |

| ALDRETTI, ANTHONY G |

| ALDRETTI, TAMMY J |

| ALESHIRE, THOMAS |

| ALESSI, JOHN DO |

| ALESSI, JOHN R |

| ALEXANDER, C WJR |

| ALEXANDER, ROBERT L |

| ALEXANDER, ROBERT V |

| ALEXANDROWICZ, JOHN S |

| ALFANO, PIETRO |

| ALFIMOW, VICTOR |

| ALFONSO, DAIMI |

| ALFONSO, JOSEPH |

| ALFONSO, ROXANNA P |

| ALGIEN, CELINA |

| ALICE, SCHULTZ TRUST |

| ALIRES, MARY |

| ALJINOVICH, JAY J |

| ALL PRO FARMS |

| ALL SEASONS SPORTS |

| ALLEE, DALE D |

| ALLEE, KATHI |

| ALLEMON, ASHLEY |

| ALLEN, BRIAN |

| ALLEN, DONALD F |

| ALLEN, DOROTHY A |

| ALLEN, JIM |

| ALLEN, KRISTY |

| ALLEN, RICKY J |

| ALLEN, ROBERT |

| ALLEN, ROBERT G |

| ALLEN, SHELLI K |

| ALLEN, SUSAN M |

| ALLEN, TERRY L |

| ALLEN, WILLIAM L |

| ALLEY, ROBERT |

| ALLGIRE, ROBERT L |

| ALLIANCE INSURANCE SOCO INC |

| ALLISON, ARLA |

| ALLISON, BRANDON J |

| ALLISON, MICHAEL |

| ALLISON, ORLANDO C |

| ALLISON, ROBERT C |

| ALLISON, THOMAS G |

| ALLMAN, CLESSON D |

| ALLMAN, LAURA L |

| ALLSUP, JOHN V |

| ALMAREZ, ANTHONY |

| ALMAREZ, RAYMOND JR |

| ALMAREZ, TOM M |

| ALMASI, ELSA L |

| ALPINE OIL AND ROYALTY |

| ALPINE ROSE CAFE |

| ALPS, CLIFFORD M |

| ALQUIST, PAULA |

| ALSPAUGH, DEBORAH R |

| ALVARADO, BILLY |

| ALVARADO, JENNIFER R |

| ALVARADO, LARRY W |

| ALVARADO, MELODY |

| ALVARADO, WALTER A |

| ALVAREZ, DESTIN |

| ALVAREZ, SATURNINO |

| ALVIDREZ, CYNTHIA |

| ALVIS, ADRIA |

| AM WEST SAVINGS ASSOC |

| AMADOR, VIRGINIA |

| AMANN, PEGGY S |

| AMATO, BROTHERS |

| AMAYA, GEORGE D |

| AMBLER, JESSE V |

| AMBURGY, LEONARD A |

| AMBUSH, LLC |

| AMERICAN FUELS INC |

| AMES, LONNIE |

| AMICK, HARRY |

| AMIDEI, LEE |

| AMIGO, NET |

| AMMAN-KELLY, SANDRA L |

| AMOCO PRODUCTION - RATO |

| AMPARAN, DOLORES |

| ANDERS, CAROLYN |

| ANDERSON, ALAN |

| ANDERSON, AUSTIN |

| ANDERSON, BARBARA |

| ANDERSON, BETTY F |

| ANDERSON, CAROLYN |

| ANDERSON, D E |

| ANDERSON, DON |

| ANDERSON, DUANE M |

| ANDERSON, ELIZABETH |

| ANDERSON, FRED M |

| ANDERSON, JAMES R |

| ANDERSON, JOHN D |

| ANDERSON, LEO |

| ANDERSON, LESLIE B |

| ANDERSON, MARK |

| ANDERSON, MICHAEL D |

| ANDERSON, MIKE S |

| ANDERSON, NATHAN D |

| ANDERSON, NITA |

| ANDERSON, RICHARD B |

| ANDERSON, ROBERT L |

| ANDERSON, RODNEY K |

| ANDERSON, TRAVIS R |

| ANDRADE, MICHAEL M |

| ANDREATTA, BARBARA |

| ANDREATTA, CARROLL A |

| ANDREATTA, DAVID LEE |

| ANDREATTA, ERIC |

| ANDREATTA, FRANK |

| ANDREATTA, HILLARY C |

| ANDREATTA, JILL |

| ANDREATTA, LORETTA |

| ANDREATTA, MICHELLE R |

| ANDREWS, CHARLES J |

| ANDREWS, CURTIS |

| ANDREWS, LINDA |

| ANGARAN, ANGELO |

| ANGEL, RONALD R |

| ANGELOVICH, REX |

| ANGER, SCOTT E |

| ANGIE'S LIQUOR EXPRESS |

| ANNAS, ACRES |

| ANNETTE'S BEAUTY SHOP |

| ANON, JASON A |

| ANS ENTERPRISES |

| ANSEL, SHARON K |

| ANSELMO, TODD J |

| ANSLEY, BRIAN L |

| ANSLEY, STEPHEN |

| ANTHONY, PAUL L |

| ANTLE, ANNETTE |

| ANTLE, J M |

| ANTONIONI, ARTHUR |

| ANTU, LUIS M |

| ANTU, PATRICIA E |

| ANTU, TONYA M |

| APISHAPA LAND & CATTLE |

| APODACA, FLORAIDA O |

| APODACA, LOUIS JR |

| APODACA, MARTHA |

| APPLE, ALVERA |

| APPLEBY, PATTY A |

| APPLEHUNT, EVA |

| APPLETON, JOHN A |

| ARAGON, ADAM A |

| ARAGON, ADORO |

| ARAGON, DESIREE D |

| ARAGON, DESIREE K |

| ARAGON, DINO L |

| ARAGON, EUGENE |

| ARAGON, FRANCES |

| ARAGON, JESSICA M |

| ARAGON, JOE M |

| ARAGON, JOHN J |

| ARAGON, LORIN V |

| ARAGON, LOUISE E |

| ARAGON, MARLENE A |

| ARAGON, MIGUEL |

| ARAGON, NORMA J |

| ARANDA, ROSARIO |

| ARBURN, ROBERT |

| ARCHER, CARL |

| ARCHER, CINDY K |

| ARCHER, ROBERT W |

| ARCHULETA, BERTHA A |

| ARCHULETA, BRIAN |

| ARCHULETA, DANIEL |

| ARCHULETA, GEORGE D |

| ARCHULETA, GUS |

| ARCHULETA, IRENE |

| ARCHULETA, J C |

| ARCHULETA, JEANNE M |

| ARCHULETA, JOE C |

| ARCHULETA, JOHN F |

| ARCHULETA, MALAQUIAS |

| ARCHULETA, MARINA |

| ARCHULETA, MARY |

| ARCHULETA, MEGAN N |

| ARCHULETA, TROY |

| ARCHULETA, WILLIAM |

| ARCHULETTA, MACY D |

| ARCO OIL & GAS COMPANY |

| ARD, KIRT D |

| ARELLANO, ALAN |

| ARELLANO, FELIX M |

| ARELLANO, FRED |

| ARELLANO, JOSE VJR |

| ARGO, MARK D |

| ARGON 2 ALL LLC |

| ARGUELLO, CHRISTOPHER M |

| ARGUELLO, DAVID M |

| ARGUELLO, JOANIE |

| ARGUELLO, JUANITA G |

| ARGUELLO, RICHARD |

| ARGUELLO, SILVIANO LMD |

| ARGUELLO, SIMON F |

| ARGUELLO, SUSAN |

| ARGUELLO, SUSAN M |

| ARIAS, ERNEST H |

| ARIE, JONNA L |

| ARKO, JOHN JR |

| ARKO, LEANDRA M |

| ARLINGTON, GROUP 1 |

| ARMIJO, ANTHONY J |

| ARMIJO, EDWARD D |

| ARMIJO, ERSIE E |

| ARMIJO, JACQUELINE M |

| ARMIJO, JAMES L |

| ARMIJO, JOSEPHINE |

| ARMIJO, JUANITA J |

| ARMIJO, STELLA |

| ARMIJO, TONY L |

| ARMSTRONG, CORBIN |

| ARMSTRONG, JOSEPH A |

| ARMSTRONG, JOYCE M |

| ARMSTRONG, RUSSELL T |

| ARNETT, RICHARD A |

| ARNETT, RICHARD L |

| ARNHOLD, TODD |

| ARNOLD, GILBERT |

| ARNOLD, MARCUS A |

| ARNOLD, NORMA |

| ARNOLD, PATRICIA R |

| ARNOLD, RICKY L |

| ARNOLD, ROBERT B |

| ARNOT, CHARLES W |

| ARNT, JAMES M |

| ARRIAGA, IRIS K |

| ARTHUR, GLADYS |

| ARTHURS, STEPHEN RMD |

| ARTUS, BRUCE |

| ARUTUNOFF, SERGAI |

| ARVIZO, GWENDOLYN H |

| ARWINE, PAMELA |

| ASBURY, JAMES E |

| ASCHE, KIM L |

| ASCHERMANN, ARLA R |

| ASCHOM, JEFFERY C |

| ASELTINE, BETTY J |

| ASHBY, ELEANOR |

| ASHBY, MARY E |

| ASHE, MAGDALENA |

| ASHLEY, CLOWER F |

| ASHURST, ROBERT C |

| ASKEW, REX A |

| ASKEW, W AJR |

| ASKLOF, HELLE B |

| ASPEN LEAF JOINT VENTURE I |

| ASPEN LEAF LAUNDRY |

| ASTI, WILMA B |

| ATCHISON, DAISY M |

| ATCHISON TOPEKA & SANTA FE RR |

| ATENCIO, BETTY J |

| ATENCIO, FRANCISCO L |

| ATENCIO, PENNYE |

| ATENCIO, TITUS |

| ATILANO-MONTOYA, JESSICA L |

| ATKINS, RAY D |

| ATKINSON, ANDREA A |

| ATKINSON, MARY A |

| ATLANTIC RICHFIELD COMP |

| ATNIP, JERRY |

| ATWOOD, DONALD K |

| AUDIN, HOLLY A |

| AUFRICHIG, HANS |

| AUFRICHTIG, RALPH H |

| AULD, DONALD F |

| AUSTEN, J HIV |

| AUSTIN, FRED WSR |

| AUSTIN, MICHAELA |

| AUSTIN, OLA |

| AUTEN, GLYNN T |

| AUTRY, CHARLES |

| AVALOS, JOSEPH A |

| AVCO FINANCIAL SERIVCES |

| AVERY, DORIS E |

| AVERY, LANDON L |

| AVI, ELAINE |

| AVI, ELAINE L |

| AVILA, LABETTINA |

| AVILA, PATTY |

| AVILA, TIMOTHY R |

| AVILA, TYRA M |

| AVILA-PADILLA, ROSE A |

| AWMILLER, SUSAN L |

| AYERS, ANDREA L |

| AYLER, SAGE C |

| AYRES, DONALD E |

| B P O E ELKS HOME |

| BABB, KATHERINE V |

| BABCOCK, GENE |

| BACA, BILLIA |

| BACA, CHRYSTELLA A |

| BACA, JAMES |

| BACA, JAMES PJR |

| BACA, MICHAEL G |

| BACA, PAMELA M |

| BACA, RAY |

| BACA, ROBERT S |

| BACA, SAM |

| BACA, TOMACITA |

| BACA, YOLANDA R |

| BACCA, KATHY |

| BACHICHA, JOSE R |

| BACHICHA, MANUEL |

| BACHICHA, RALPH J |

| BACK, TAMMY |

| BACON-APPLEGATE, LYNNE L |

| BADO, JOHN T |

| BAGBY, W M |

| BAGGETT, JOE B |

| BAGWELL, JOHN H |

| BAILEY, ANTIONETTE |

| BAILEY, BERNADINE M |

| BAILEY, BILL |

| BAILEY, BROOKE |

| BAILEY, GREG |

| BAILEY, KENNETH |

| BAILEY, LARRY J |

| BAILEY, MARY |

| BAILEY, ROBIN P |

| BAILEY, RUBY L |

| BAILEY, T W |

| BAIONE, PETE |

| BAIRD, HARRY E |

| BAITY, CORY S |

| BAITY, KEVIN J |

| BAKER, CHIP |

| BAKER, D J |

| BAKER, ED H |

| BAKER, ERIC |

| BAKER, GLENN A |

| BAKER, HEATHER |

| BAKER, JUSTIN E |

| BAKER, MICHELLE M |

| BAKER, RICHARD L |

| BAKER, STELLA M |

| BAKER, TINA |

| BALAN, DANIEL C |

| BALAUN, DAVID M |

| BALDRIDGE, JOE E |

| BALDWIN, CHARLES R |

| BALDWIN, GARY L |

| BALDWIN, LOUIS R |

| BALL CHIROPRACTIC CENTER |

| BALL, DEBRA |

| BALL, JOHN F |

| BALL, REMA |

| BALLARD, WALTER WJR |

| BALLEWEG, KENNETH J |

| BALLEWEG, ROBERT E |

| BALLOUN, GEORGE R |

| BALUSEK, MERNA |

| BAMBER, MARY A |

| BAMBERGER, ANTHONY S |

| BANGS, HAROLD |

| BANHAM, ROBERT W |

| BANKER, GAYLE I |

| BANKS, MICHAEL J |

| BANKSON, HAZEL A |

| BANKSON, IDA L |

| BANNING, MICHAEL A |

| BANNON, CHARLEY B |

| BAPTISTA, MARTHA |

| BAQUET, BRYAN |

| BAQUET, CLYDE R |

| BAR H RANCH LTD |

| BARAJAS, JOE JR |

| BARAJAS, PETE JR |

| BARAN, AMY H |

| BARBACOVI, EVELYN M |

| BARBER, BRANDON M |

| BARBER, LEO F |

| BARBER, THOMAS R |

| BARBIERE, MICHAEL JR |

| BARBOUR, WORTH L |

| BARCA, SHERI R |

| BARELA, ANASTACIO |

| BARELA, HELEN M |

| BARELA, JAMES A |

| BARELA, JIM |

| BARELA, JOE |

| BARELA, JOSEPH J |

| BARELA, JUAN R |

| BARELA, LAWRENCE |

| BARELA, TRACY M |

| BARGER, ALBERTA C |

| BARIA, DANIEL |

| BARKER, BARBARA |

| BARKER, JUDY |

| BARKER, LUKE C |

| BARKER, MAE |

| BARKHOEFER, WILLIAM |

| BARNES, BOB L |

| BARNES, CHESTER |

| BARNES, ERIK A |

| BARNES, GEORGE D |

| BARNES, KATHERINE |

| BARNETT, HELEN H |

| BARNETT, LUTHER O |

| BARNETT, PAUL SJR |

| BARNETT, REID |

| BARNHILL, DONALD B |

| BARNHILL, JOHN |

| BAROS, BILLIE |

| BAROS, DAVINIA |

| BAROS, GERALDINE D |

| BAROS, MARIA |

| BAROS, TIFFANY O |

| BAROZ, ISIDORE R |

| BARR, CLAYTON R |

| BARRACLOUGH, MICHAEL H |

| BARRETT, KATHERYNE |

| BARRETT, RANDALL |

| BARRON, JOSEPH A |

| BARRON, NORA J |

| BARROW, TARA |

| BARROWS, BARBARA E |

| BARROWS, LEROY E |

| BARSUK, ROBERT P |

| BARTELS CONSTRUCTION |

| BARTH-WARREN, GAIL |

| BARTLETT, ROY C |

| BARTLEY, THOMAS |

| BARTLEY, THOMAS E |

| BARTMESS, WILLIAM J |

| BARTO, MELVIN L |

| BARTON, HERB |

| BARTON, RICHARD D |

| BART'S PROPANE SERVICE |

| BARWICK, KATHLEEN M |

| BASIL, DIANA L |

| BASQUES, JESSE |

| BASSETT, CABOT |

| BASSI, LOUIS |

| BASSI, ROSE |

| BATE, HARRY C |

| BATES, HELEN D |

| BATTEST, NORMAN L |

| BATUELLO, JOE |

| BATUELLO, MARIO |

| BATUELLO, VERNA M |

| BATULIS, BARBARA L |

| BAUDINO, GERALD B |

| BAUDINO, ROBERT G |

| BAUER, HORST |

| BAUER, TERRY D |

| BAUERNFEIND, JOSHUA J |

| BAUGHMAN, JAMES E |

| BAUMANN, KATIE M |

| BAUMGARTNER, LESLIE A |

| BAXTER, GUY D |

| BAXTER, JOHN W |

| BAXTER, KATHY E |

| BAY, WARREN G |

| BAYCI, BRET |

| BAYES, WYLIE |

| BAYLESS, MARY G |

| BAYLESS, WAYNE A |

| BAYS, J C |

| BAYSINGER, JAMES H |

| BAYUK, JEAN F |

| BEACH, JAMES |

| BEALL, JOHN L |

| BEAN, CHARLES W |

| BEAN, MARCIA A |

| BEAN, ROBERT A |

| BEAR HEAD ENTERPRISES I |

| BEARD, D J |

| BEARDEN, DAVID A |

| BEARDSLEY, JOHN W |

| BEARS HEAD RANCH LLC |

| BEASLEY, DOYLE |

| BEASLEY, DUSTIN R |

| BEASLEY, KENNETH W |

| BEATON, MICHELLE |

| BEAUCHAMP, PAUL J |

| BEAUDOIN, JIM R |

| BEAUDOIN, THOMAS L |

| BEAVERS, ALAN |

| BEBO, DELPHINE J |

| BECHAVER, SUSAN |

| BECK, BILLY J |

| BECK, BOB |

| BECK, CLARENCE |

| BECK, GEORGE PMD |

| BECK, KEITH D |

| BECK, LORRAINE |

| BECK, ROGER |

| BECKER, D R |

| BECKER, DAVID E |

| BECKER, DONALD W |

| BECKER, HORST H |

| BECKHART, DOROTHY |

| BEEBE, HILDA |

| BEEBE, KEN |

| BEEBE, RICHARD F |

| BEEMAN, ROBERT S |

| BEER, ELDON F |

| BEERY, MICHAEL L |

| BEESON, DEBORAH M |

| BEGANO, JOHN |

| BEGANO, ROBERT LSR |

| BEGLEY, DAVID J |

| BEHAVIN, FLORENCE E |

| BEHNKE, MELVIN J |

| BEISNER, SARAH E |

| BELARDE, JIM |

| BELDEN, WILLIAM J |

| BELISLE, CLAUDE |

| BELL, ALECK |

| BELL, CHRISTINA K |

| BELL, JONATHAN |

| BELL, M H |

| BELL, MAGDALENE |

| BELL, MARK J |

| BELL, MELVIN H |

| BELLAH, ESPERANZA |

| BELLER, AUDIE P |

| BELLER, KURT |

| BELLER, LARRY |

| BELLER, LEANNE M |

| BELLOTTI, ROSE A |

| BELLOWS, RICHARD W |

| BELMAR, GEORGIA K |

| BELMONTE, CARMINE JR |

| BELVEDERE RANCH HOLDINGS LLC |

| BENAVIDEZ, BRITTANY A |

| BENCH, NAOMI |

| BENDELL, BRUCE A |

| BENDELL, KARATE |

| BENDELL, SHIRLEY A |

| BENEDICT, CLARENCE A |

| BENEFICIAL STD MORTG IN |

| BENEFIEL, ROBERT A |

| BENESTANTE, CONNIE S |

| BENIGHT, ROBERT L |

| BENINE, A R |

| BENINE, ARIEL A |

| BENINE, GENE RJR |

| BENJAMIN, GEORGE |

| BENJAMIN, TODD D |

| BENNETT, DANA R |

| BENNETT, H D |

| BENNETT, JACOB A |

| BENNETT, JAN M |

| BENNETT, JOHN |

| BENNETT, M C |

| BENNETT, MICHAEL A |

| BENNETT, RAYMOND |

| BENNETT, THOMAS M |

| BENNETTS, ROBERT E |

| BENSIK, BRUCE E |

| BENSON, ERIC A |

| BENSON, ETHEL |

| BENSON, LOTTIE |

| BENSON, MARK |

| BENT, DAVID C |

| BENTLEY, WILLIAM R |

| BENZING, ROBERT J |

| BERDAIS, ROBERT R |

| BERENTZ, JOHN RJR |

| BERG, DON W |

| BERGAMO, JOE |

| BERGEMANN, MELVIN L |

| BERGER, DAVID |

| BERGER, THOMAS G |

| BERGLAND, CHANDOS R |

| BERGMAN, ELISABETH |

| BERGQUIST, CLEO R |

| BERKENBILE, CHRISTOPHER |

| BERNAL, JANICE |

| BERNAL, ROSALIE |

| BERNAL, ROSE A |

| BERNARD, BARBARA L |

| BERNARD, JAY BIII |

| BERNER, R J |

| BERREMAN, C W |

| BERRY, ANDREW |

| BERRY, CURTIS L |

| BERRY, DIANE T |

| BERRY, DONALD L |

| BERRY, JACQUELINE |

| BERRY, LISA |

| BERRY, RORRI J |

| BERRY, STANLEY |

| BERRY, TAUSHA L |

| BERRY, THOMAS A |

| BERRY, VONNIE |

| BERTA, CANDACE |

| BERTHOLF, JOHN |

| BERTOLDI, AUGUST |

| BERTOLINO, TERESA |

| BERTRAM, BETTY |

| BERTUGLIA, CATHERINE |

| BERUMEN, ANTHONY |

| BESEMER, MARK |

| BESIO, PAUL F |

| BETOW, BURTON |

| BEUCLER, HARLAN |

| BEULAH INN 78-98 C/O LA VAN |

| BEULAH INN C/O BATES |

| BEULAH INN 2018-2022 |

| BEULAH VALLEY SADDLE CLUB |

| BEULAHLAND ART STUDIO |

| BEURMAN, ALBERT L |

| BEVANS, BETTY |

| BEYDA, MORRIS J |

| BEZONA, RYAN L |

| BIBLE, DONNA K |

| BIBLE, ERIC A |

| BIBY, LINDA S |

| BIBY, ROBERT L |

| BICKEL, ALICIA D |

| BICKETT, KURTIS J |

| BIDULA, ADRIENNE R |

| BIEFEL, BRYCE |

| BIERSDORFER, JOHN W |

| BIERWAGEN, CLAYTON K |

| BIG CANYON & TYRONE GRAZING |

| BIG PRODUCTION LLC |

| BIG WHEEL BAR-B-QUE & BAKERY |

| BIGGI, HARRY |

| BIGHAM, KENNETH D |

| BIGLEY, BARBARA |

| BIHM, TIM |

| BILLINGS, BEN |

| BILYEW, DEBORAH J |

| BINDER, CHARLES P |

| BINDER, RONALD E |

| BINGHAM, ANDREW |

| BINGHAM, JAMES L |

| BINGHAM, JOSHUA H |

| BIONDI, FRED |

| BIONDI, JOHN |

| BIRON, PAUL V |

| BISE, CHARLES R |

| BISE, CHARLOTTE |

| BISHARA, MARILYN K |

| BISHOP, ANAJEAN |

| BISHOP, CARL |

| BISHOP, DEE E |

| BISHOP, MAX |

| BISHOP, ROBERT D |

| BISHOP-MCCOMB, MARILYN |

| BISS, WILLIAM J |

| BITTLE, ABIGAIL |

| BIVENS, OREN T |

| B-J'S |

| BLACKBURN, HENRY |

| BLACKHURST, SARA L |

| BLACKMAN, ROBERT D |

| BLACKMORE, CATHLEEN |

| BLACKWELL, BEN |

| BLACKWOOD, CHARLES S |

| BLACKWOOD, LARRY |

| BLAGG, GENE |

| BLAHUTA, GEORGE A |

| BLAIR, FLORENTINO E |

| BLAIR, ROBERT M |

| BLAKE, CRAWFORD |

| BLAKE, JAMES |

| BLAKE, MITCHEL |

| BLAKE, NAOMI J |

| BLAKEMORE LAND CO=3169032711 |

| BLAN, ARMELINDA |

| BLANCHARD, ALYSSA M |

| BLANK, BEN |

| BLANK, DAVID L |

| BLANKENSHIP, A G |

| BLANKENSHIP, TRACI |

| BLANTON, C B |

| BLANTON, LAURA A |

| BLASE, JAMES W |

| BLASI, ANTHONY A |

| BLASI, BRIAN A |

| BLASKOVICH, MOLLY C |

| BLAZIS, FRANK P |

| BLEA, MARY |

| BLISS, JOANN |

| BLOCKER, DANNY L |

| BLOEDORN, CHEYENNE A |

| BLOOR, ROBERT J |

| BLOUNT, EDWARD A |

| BLUE, BARBARA R |

| BLUE, SKY FARMS LLP |

| BLUTE, JOSEPH F |

| BOATMUN, JACK |

| BOATNER, BRIAN |

| BOB, LEE'S |

| BOBIAN, SILVANO |

| BOBIAN, THOMAS |

| BOB'S PLACE |

| BOCEK, DOUGLAS |

| BOCIM, GLORIA V |

| BOCOCK, RANDY |

| BOCOCK, RANDY W |

| BODA, LILY E |

| BODAY, ALEX |

| BODINE, IVAN P |

| BOECHER, R C |

| BOEGLI, ROLF |

| BOEHM-DARRAH, KIMBERLY |

| BOERNER, DAWN D |

| BOETTCHER, CATHERINE A |

| BOGART, STEPHANIE J |

| BOGER, DANIEL |

| BOGGS, SUSANNE A |

| BOGNER, DONNA |

| BOHANNON, KYLE D |

| BOHN, BETTY |

| BOHNEN, LYNNE |

| BOLAND, ROBIN W |

| BOLANOS, JESUS S |

| BOLE, MICHAEL W |

| BOLES, SCOTT H |

| BOLEY, RUSSELL |

| BOLIN, RANDY G |

| BOLINGER, WESLEY |

| BOLLING, NASBY W |

| BOLLINGER, JACK |

| BOLLIVAR, ROBERT L |

| BOMBARDIER, DON |

| BON, DURANT BERTHA J |

| BON, GINA |

| BONATA, A P |

| BOND, BARBARA |

| BOND, MIRANDA J |

| BOND, RAYMOND |

| BOND, ROBERT |

| BOND, TOBBIE |

| BONFIGLIO, JOSEPHINE |

| BONHAM, ALTA M |

| BONHAM, MARY F |

| BONHAM, ORVILLE D |

| BONICELLI, CORNER |

| BONOMI, VICTOR |

| BOONE, ELIZABETH |

| BOONE, ROBERT G |

| BOONE, RUTH P |

| BOOTH, JOSHUA B |

| BOOTH, MARY |

| BORCHARD, ELSA C |

| BORDEN, ANDY J |

| BORDEN, JENELLE S |

| BOREN, RICHARD L |

| BORJA, JENIFER |

| BORJA, JENNIFER M |

| BORNOS, BRIAN A |

| BOROWIAK, KAREN |

| BORREGO, ALVIN |

| BORREGO, JOE |

| BORREGO, MARK |

| BORREGO, SILVIA G |

| BORREGO, VERNON K |

| BORSA, VALERIE |

| BORSKI, LEAH R |

| BORST, DARRELL L |

| BOSMAN, DONALD |

| BOSSHARD, CAROLYN L |

| BOSTER, CHRISTIAN P |

| BOSTICK, CLARENCE C |

| BOSTON, ALBERT E |

| BOSWELL, DARWIN L |

| BOSWELL, THOMAS F |

| BOTELLO, CYNTHIA |

| BOUGHTON, MATT L |

| BOUNDS, R S |

| BOURASSA, RONALD R |

| BOUTCHER, CHARLES J |

| BOVE, CHRISTOPHER A |

| BOVILL, RANDY J |

| BOW AND ARROW RANCH 1991 |

| BOW AND ARROW RANCH 84-90 |

| BOWEN, D M |

| BOWEN, J E |

| BOWER, ROLAND C |

| BOWERS, EMILY L |

| BOWLES, SUSAN H |

| BOWLING, TROY |

| BOWMAN, ADOLPH |

| BOWMAN, JOHN |

| BOWMAN, LOUIS |

| BOWMAN, ROBERT G |

| BOWMAN, TANNER J |

| BOX, BOYD |

| BOX, C K RANCH |

| BOXLEY, CHRISTINE A |

| BOYCE, JAMES PJR |

| BOYD, CHRISTIAN I |

| BOYD, L R |

| BOYD, RUBY S |

| BOYD, W P |

| BOYER, CHRIS J |

| BOYER, SHON L |

| BOYES, SARAH L |

| BOYNTON, KAREN |

| BRACCO, EUGENE |

| BRACCO, MEAT COMPANY |

| BRACKETT, JAMES |

| BRAD HALL INC DBA SOCO SERVICE |

| BRADBURN, JOHN R |

| BRADDY, SHERRY |

| BRADEN, EDDIE E |

| BRADFORD, JAMES R |

| BRADLEY, BARRY R |

| BRADLEY, DON R |

| BRADLEY, JENNIFER R |

| BRADLEY, LAURIE |

| BRADLEY, RODNEY W |

| BRADY, CHARLES L |

| BRAIN, JEFF C |

| BRALY, O L |

| BRAMALL, JOHN R |

| BRAM-KARP, PEARL J |

| BRANAUM, IMA M |

| BRANCH, ANNETTE A |

| BRANCH, BILLY T |

| BRANCH, RAYMOND |

| BRANCOLE, INC |

| BRANDENBURG, DARREN S |

| BRANDENBURGH, LAREDO D |

| BRANDON, ROXANNA L |

| BRANDT, D C |

| BRANDT, JON W |

| BRANDT, W H |

| BRANHAM, CAROL |

| BRANIN, NANCY R |

| BRANOM, CHRISTINA M |

| BRANSON-TRINCHERA, LADIES CLUB |

| BRANUM, DONALD |

| BRASHAR, GARY K |

| BRASIEL, KEN |

| BRASSEA, MARIA M |

| BRASSELERO, DEBORAH L |

| BRASSILL, JOANN A |

| BRASWELL, CALEB M |

| BRATINA, WILLIAM AJR |

| BRAUTIGAM, ADAM |

| BRAVO, ABRAHAM L |

| BRAZ, PEGGY A |

| BREAKALL, LEONA M |

| BREEDLOVE, NAOMI |

| BREER, EDNA |

| BREGENZER, DONNA M |

| BRENNAN, CHARITY A |

| BRESCIANI, ESTHER |

| BRESKE, ALEX P |

| BREWER, BARBARA |

| BREWER, JAMES R |

| BREWER, WES |

| BREWSTER, CHARLEY C |

| BREWSTER, ELLOUISE |

| BREWSTER, STEVEN |

| BREWSTER, WINDY A |

| BREZINKA, ROSS |

| BRGOCH RANCH |

| BRIAN CIARLO TRUST |

| BRICKMAN, BARBARA |

| BRICKMAN, CHARLES |

| BRIDEAU, MICHAEL |

| BRIDGEMAN, SHARON R |

| BRIDGES, LINETTE |

| BRIDGES, R C |

| BRIETWEISER, PAMELA F |

| BRIGGS, GERTRUDE M |

| BRIGGS, LILIAN B |

| BRIGGS, RAHIL D |

| BRIGIDO, JOSE L |

| BRINDLEY, VERNA |

| BRINSKO, DIANA S |

| BRITE, WAYNE C |

| BRITT, JOSEPH |

| BRITT, MINTA A |

| BRO, REED F |

| BROACH, LAWRENCE W |

| BROADWAY, LIQUOR |

| BROCK, CLAUDE M |

| BROCK, PAIGE |

| BROCKMAN, JOHN V |

| BRODIE, STELLA L |

| BRODINE, LYNN |

| BROGOWSKI, THEODORE P |

| BRONKEN, RICHARD F |

| BROOKS, DAN A |

| BROOKS, GARY |

| BROOKS, GEORGE F |

| BROOKS, JOHN W |

| BROOKS, KYLE T |

| BROOKS, MARY S |

| BROOME, THOMAS R |

| BROUGHER, MATTHEW T |

| BROUSSARD, REBECCA L |

| BROWER, JACK |

| BROWN, AMBER K |

| BROWN, BOBBY J |

| BROWN, C E |

| BROWN, CHRIS |

| BROWN, DEREK J |

| BROWN, DOUGLAS |

| BROWN, EARL B |

| BROWN, GARY A |

| BROWN, JAMES D |

| BROWN, JOEL BJR |

| BROWN, JOHN W |

| BROWN, JOHNNY T |

| BROWN, JONATHAN |

| BROWN, LARRY Z |

| BROWN, LOREN M |

| BROWN, MARK P |

| BROWN, NORMAN L |

| BROWN, RAY H |

| BROWN, RENEE |

| BROWN, RICHARD E |

| BROWN, RICK |

| BROWN, ROBERT L |

| BROWN, RON |

| BROWN, RUSSELL |

| BROWN, STEPHANIE |

| BROWN, STEPHEN P |

| BROWN, SYLVIA A |

| BROWN, THOMAS |

| BROWN, VIVIAN L |

| BROWN, WILLIAM H |

| BROWN-COOK, ELINOR |

| BROWNING, KEITH L |

| BROWNING, NEVAEH M |

| BROWNING, SHERRY |

| BROYLES, ROBERT |

| BRUBAKER, ANGELA N |

| BRUCE, CARL G |

| BRUCE, KAREN K |

| BRUCE, ROBERT M |

| BRUDEN, JANET L |

| BRUMFIELD, EDWARD |

| BRUMIT, WAYNE L |

| BRUMMETT, W AJR |

| BRUNELLI, JON |

| BRUNELLI, MARY C |

| BRUNELLI, MICHELLE R |

| BRUNELLI, ROGER |

| BRUNELLI, ZAC |

| BRUNER, CURTIS L |

| BRUNER, JULIUS J |

| BRYAN, BRUCE A |

| BRYAN, DONALD D |

| BRYAN, REX C |

| BRYAN, RILEY |

| BRYANT, JUDITH A |

| BTCSC |

| BUCCI, CINDY |

| BUCCI, JOSEPH E |

| BUCHANAN, WILLIAM |

| BUCHER, JOHN |

| BUCHHOLZ, LOUIS J |

| BUCHSCHACHER, JOHN W |

| BUCHSCHACHER, SAVANNAH |

| BUCK, ALAN R |

| BUCK, DON |

| BUCK, ETHEL |

| BUCK, KIMBERLY M |

| BUCK, PEARL |

| BUCK, THOMAS J |

| BUCKALLEW CUSTOM HOMES INC |

| BUCKALLEW GLENN E |

| BUCKALLEW, LARRY E |

| BUCKALLEW, LAURA |

| BUCKHORN RIDGE OUTFITTERS LLC |

| BUCKLEY, CRYSTAL J |

| BUCKLEY, FLORENCE |

| BUCKLEY, INEZ I |

| BUCKRIDGE, DAVID L |

| BUDA, JASMINE N |

| BUDD, KEITH |

| BUDERUS, JESSICA L |

| BUENO, KATHY M |

| BUENO, LISA |

| BUERKLE, SHANNON J |

| BUFFALO, JUSTIN N |

| BUFMACK, ANDREA L |

| BUHL, LINDA A |

| BUHR, JAYSON C |

| BUJACK, FRED A |

| BUKOWSKI, THERESA M |

| BULINSKI, BERNARD R |

| BUMGARNER, STUART A |

| BUNETA, JAYME L |

| BUNETA, MILAN J |

| BUNN, TAMRA |

| BUNYARD, EVAN M |

| BURBIDGE, EMILY |

| BURCH, JOSHUA E |

| BURCHAM, DEE H |

| BURCHARD, MICHAEL |

| BURDEKIN, DEWINA |

| BURDETSKY, KATRINA L |

| BURGAT, CHARLES LOD |

| BURGER, H E |

| BURGER, STATION |

| BURKE, OTIS |

| BURKES, TOMMY |

| BURKEY, PHYLLIS J |

| BURKHART, MICHAEL L |

| BURKHART, VERNON C |

| BURLESON, BLAKE |

| BURLESON, L E |

| BURMOOD, HEATHER D |

| BURNER, GLEN |

| BURNETT, DONALD B |

| BURNS, DAVID C |

| BURNS, H R |

| BURNS, J D |

| BURNS, ROBERT |

| BURNS, S E |

| BUROWS, WILLIAM |

| BURRESS, J W |

| BURRIS, TYLER |

| BURROUGHS, LACEL |

| BURROUGHS, LARRY |

| BURT, H H |

| BURTON, ARTHUR M |

| BURTON, DAVID |

| BURTON, DOROTHY |

| BURTON, GLADYS E |

| BURTON, JEAN A |

| BURZYNSKI, ROBERT G |

| BUSCH, ANTHONY W |

| BUSCH, DENNIS L |

| BUSCH, RITA |

| BUSCH, SHAWN G |

| BUSH, CHARLES F |

| BUSH, HAROLD L |

| BUSHAW, LYNNETTE |

| BUSSEY, LINDA M |

| BUSSEY, RICHARD B |

| BUSTOS, KASSANDRA E |

| BUTCHER, CAL J |

| BUTERO, ROBERT A |

| BUTERO, SHIRLEY |

| BUTLER, C L |

| BUTLER, DAVID |

| BUTLER, E W |

| BUTLER, KENNETH L |

| BUTLER LIVING TRUST |

| BUTLER, SEYMOUR S |

| BUTLER, SHERRI M |

| BUTLER, TEDDY E |

| BUTTS, JAMES H |

| BUTZ, WALTER H |

| BUXBAUM, BRENT |

| BUXMAN, GARY |

| BYARS, ELEANOR F |

| BYERLY, KAYLEE M |

| BYERLY, THOMAS K |

| BYERS, MICHELLE |

| C & L STONE BUILDERS INC |

| C & R ARCHITECTURAL PRODUCTS |

| C I - RAY RANCH |

| C L C PROPERTIES |

| CACTUS CLEANERS |

| CADDELL, KENNETH |

| CADUFF, LAWRENCE A |

| CAGE, ERIC |

| CAGE, ERIC D |

| CAGE, LINDA |

| CAIN, STEPHEN L |

| CAIN, TUBAL |

| CALANGELO, DEBRA L |

| CALANTINO, TED S |

| CALDWELL, LISA D |

| CALDWELL, NICOLE R |

| CALDWELL, TEISHA |

| CALHOUN, JOYCE |

| CALIFANO, GERALD A |

| CALIGIURE, TRACY |

| CALLAN, M B |

| CALLIN, SALLY J |

| CALONDER, DICK |

| CAL'S H & S SUPPLY |

| CALVERT, ANNA |

| CALVERT, KENNETH A |

| CALZA, ANTHONY J |

| CALZA, BARNEY |

| CAMACHO, JOSE L |

| CAMARILLO, LISA A |

| CAMERLO, DAIRY |

| CAMERON, ANDREW M |

| CAMERON, WALTER J |

| CAMERON, WILLIAM L |

| CAMP, APRIL |

| CAMP, MCGWIRE |

| CAMP SALVATION AMERICA |

| CAMPBELL, CELIA A |

| CAMPBELL, MILTON L |

| CAMPBELL, REBECCA L |

| CAMPBELL, RICHARD |

| CAMPBELL, SHILO GJR |

| CAMPBELL, STELLA L |

| CAMPBELL, TREVOR D |

| CAMPER, CHARLA |

| CAMPER, JOHN |

| CAMPER, KATHERINE |

| CAMPOS, BELINDA P |

| CAMPOS, ERNESTO |

| CAMPOS, JESUS F |

| CAMPOS, MICHAEL |

| CAMPUS, INN |

| CANADA, THOMAS R |

| CANCHOLA, ZACKARY A |

| CANCINO, BOBBY L |

| CANDLE, MARGARET |

| CANNACO, II |

| CANNADY, GLENNA |

| CANNEDY, CHARLES |

| CANNEDY, GARY |

| CANNON, NYCHOLE C |

| CANNON, PHYLLIS L |

| CANNON, RUTH M |

| CANNON-RENTAL, JACKIE |

| CANNY, ROBERT F |

| CANO, ANGIE |

| CANO, ANTHONY C |

| CANTIN, BERNARD A |

| CANTRELL, CHARLES H |

| CAPLE, LINDA L |

| CAPPELLUCCI, BERNADETTE C |

| CAPPELLUCCI, HELEN |

| CAPPELLUCCI, MARK W |

| CAPPELLUCCI, MIKE |

| CAPPELLUCCI, ROBERT |

| CAPUTO, CHARLES |

| CAR, DOCTOR |

| CARAVAS, ANDREW |

| CARBAJAL, ARMANDO R |

| CARBON SEQUESTRATION CONSULT |

| CARDENAS, CECILIA |

| CARELLI, RIKKIE |

| CAREY, STEVEN R |

| CARING, UNLIMITED |

| CARKHUFF, BEVERLY |

| CARL DUNSMORE AND SON |

| CARLEO, MARLA T |

| CARLISLE, GAIL T |

| CARLSON, CHRISTOPHER J |

| CARLSON, DANIEL S |

| CARLSON, GUS M |

| CARLSON, HELEN J |

| CARLSON, JOHN W |

| CARLSON, LA VERNE E |

| CARLSON, RICHARD D |

| CARLSON, SHAUN D |

| CARLSON-GRIFFITH, ELENA S |

| CARMAN, FRED |

| CARNES, DANIEL J |

| CAROLINE'S, BAR |

| CARONE, CAROLYN Y |

| CAROTHERS, CHARLES W |

| CARPENTER, BEN |

| CARPENTER, BEN R |

| CARPENTER, CHEYENNE |

| CARPENTER, ELSIE |

| CARPENTER, M B |

| CARR, MARIA |

| CARRAHER, JOHN M |

| CARRILLO, ALFRED S |

| CARRILLO, CARL R |

| CARRILLO, JOE V |

| CARRILLO, RAMIRO F |

| CARROLL, DANIEL G |

| CARROLL, JACKLYN S |

| CARROLL, MICHAEL |

| CARRUTH, ANN |

| CARRUTH, ODIE W |

| CARSON, GARY |

| CARSON-WALKER, BRITTANY A |

| CARTER, CARLOS |

| CARTER, CHARLES L |

| CARTER, DORIS E |

| CARTER, H C |

| CARTER, HAL E |

| CARTER, JEREMY A |

| CARTER, JEREMY S |

| CARTER, JOHN |

| CARTER, KENTON E |

| CARTER, RICHARD |

| CARTER, ROBERT K |

| CARTER, SAM |

| CARTER, WAYNE L |

| CARTHEL, DAN |

| CARTHEL, MITCH D |

| CARTY, JOSHUA W |

| CARUSELLE, JOSEPH |

| CARVAJAL, ALFRED M |

| CASADOS, ERNESTINE |

| CASE, ALLEN KJR |

| CASEY, ALLEN S |

| CASEY, MICHELE |

| CASEY, MICHELE D |

| CASH, DAVID J |

| CASH, HERMAN V |

| CASH, IGNAZIO P |

| CASIAS, BEN J |

| CASIAS, JOHN |

| CASIAS, MICHELLE M |

| CASIAS, MILTON E |

| CASIAS, PAULINE |

| CASIAS, RAYMOND I |

| CASIAS, RUDOLPH A |

| CASIAS, TERESINA |

| CASIAS, VICKI A |

| CASON, ROBERT D |

| CASS, ESTHER J |

| CASS, LOREN |

| CASS, TERRY L |

| CASSAI, ARMAND |

| CASSAVANT, ALLARD F |

| CASSEL, JAMES H |

| CASSEL, JIM |

| CASSIDY, EUGENE |

| CASSIDY, PATRICIA L |

| CASSIO, GARY E |

| CASTANON, JESUS A |

| CASTELLANO, DANIEL |

| CASTILLO, ARMANDO A |

| CASTILLO, BREANNE K |

| CASTILLO, NESTOR |

| CASTILLO, VINCENT |

| CASTINE & ASSOCIATES |

| CASTLE CONCRETE COMPANY |

| CASTRO, ERNEST L |

| CASTRO, ERNESTINA |

| CASTRO, LIA R |

| CASTRO, MEGAN R |

| CATALANO, KEISHA R |

| CATEGORY ONE BOTANICALS LLS |

| CATES, CAROL |

| CATES, DENZIL |

| CATHCART, TERRANCE J |

| CATLIN, JOYCE A |

| CATLIN, MARGARET Y |

| CATRON, LOREN H |

| CAUDILL, JOHN |

| CAUDLE, DONALD |

| CAUGHRON, DONALD L |

| CAUSEY, IDA L |

| CAUSTIN, LAURA |

| CAVALIERE, FRANK J |

| CAVANAGH, THOMAS H |

| CAVAZOS, RYAN A |

| CAVENDER, RICHARD L |

| CAVINESS, BOBBIE J |

| CAWLFIELD, TED |

| CCA SILBAND GOLF CORP |

| CDE BACA C |

| CEARLEY, BLAINE S |

| CEASAR, JESSICA E |

| CENTRAL FOREST PRODUCTS |

| CENTURYTEL |

| CEPLO HOMES INC |

| CEPLO, JOHN M |

| CERDA, WILLIAM O |

| CERDAY, MARGARET E |

| CERMAK, GREGORY L |

| CERNOIA, LORI D |

| CERVANTES, YANITSY |

| CERVANYK, ANDREW |

| CESARIO, CHARLES |

| CESARIO, JASON R |

| CH2M |

| CHACE, GERTIE A |

| CHACE, L E |

| CHACON, GRACE J |

| CHACON, JOHN C |

| CHACON, JOSEPH C |

| CHACON, LARRY |

| CHADEN, SYD |

| CHAIREZ, EMMA |

| CHALET, DI VIETTI LLC |

| CHAMBERLIN, JAMES A |

| CHAMBERS, KIMIKO L |

| CHAMBLES, BETTY C |

| CHAMBLIN, KIM L |

| CHAMNESS, A L |

| CHAMP, FLORENCE M |

| CHAMPEAU, BRITTANIE R |

| CHANCE, HOMER R |

| CHANCELLOR, JAMES M |

| CHANDLER, DANIEL J |

| CHANDLER, IRENE |

| CHANDLER, WILLIAM H |

| CHAPARRO, EUGENE L |

| CHAPMAN, DON A |

| CHAPMAN, MORGAN |

| CHAPMAN, RUSSELL L |

| CHAPPELL, JOLYNN R |

| CHARLIFUE, RICHARD |

| CHARLY, TOM |

| CHARTIER, KAREN A |

| CHASE, BILL J |

| CHAUDHRY, MELISSA |

| CHAUVIN, C |

| CHAVEZ, ALFONSO R |

| CHAVEZ, AMANDA |

| CHAVEZ, ANNA |

| CHAVEZ, CELESTINO |

| CHAVEZ, CHARLES E |

| CHAVEZ, EDGAR H |

| CHAVEZ, FELIX |

| CHAVEZ, FRANK P |

| CHAVEZ, JAMES |

| CHAVEZ, JODY M |

| CHAVEZ, JOHN F |

| CHAVEZ, LOUIE |

| CHAVEZ, MARIA B |

| CHAVEZ, MAX |

| CHAVEZ, RAYMOND |

| CHAVEZ, RAYMOND JR |

| CHAVEZ, ROBERT SJR |

| CHAVEZ, ROSE M |

| CHAVEZ, ROY |

| CHAVEZ, RYAN H |

| CHAVEZ, SIERRA A |

| CHAVEZ, YVONNE |

| CHAVIRA, RAY |

| CHAVKA, D W |

| CHEATHAM, CHARLES |

| CHEEK, ERNEST R |

| CHEEK, JAMES B |

| CHELON, BRIAN |

| CHELON, BRIAN R |

| CHENELER, NORMA V |

| CHER, LAWRENCE |

| CHESNEY, C L |

| CHESTER, WILLIAM I |

| CHEVREAUX, HERMAN |

| CHIAPPETTA, ROBERT |

| CHIAPPONE, PAUL A |

| CHIDLAW, C L |

| CHIDLAW, JOANN C |

| CHIESI, LOUIS R |

| CHIFALO, TONY J |

| CHILDRESS, KENNETH L |

| CHILDS, A B |

| CHITWOOD, JERRY |

| CHIVERTON, GRACE J |

| CHOATE, RICHARD D |

| CHOATE, SANDRA S |

| CHOIN, CHARLES D |

| CHOIN, JOEL B |

| CHONG, CHUNG H |

| CHORAK, MICHAEL |

| CHORAK, MICHAEL G |

| CHRISTENSEN, WILLIAM C |

| CHRISTENSON, EDWARD R |

| CHRISTESON, KRISTEN |

| CHRISTI, SUSAN M |

| CHRISTIAN, CHAPEL INC |

| CHRISTIAN, JACQUELINE J |

| CHRISTIAN, PATRICIA M |

| CHRISTIAN, RUTH A |

| CHRISTIANSEN, GEORGE |

| CHRISTIANSEN, ROBERT G |

| CHRISTMAN, MICHAEL E |

| CHUBBUCK, DON M |

| CHUB'S SUBS |

| CHUPP, BEN J |

| CHURCH, JAMES L |

| CHURCH OF CHRIST |

| CHURCHES, GORDON |

| CIARLO, MATTHEW C |

| CIRA, JESSIKA J |

| CIRCLE CHEVROLET BUICK CO |

| CIRCLE THE WAGONS |

| CIRCLE THE WAGONS RV PARK |

| CISNEROS, AMY L |

| CISNEROS, J R |

| CISNEROS, MOSES |

| CISNEROS, ROGER |

| CISNEROS, VICTOR E |

| CLAFFEY, JEANNINE |

| CLAIR, RUTH E |

| CLARK, ALEX JR |

| CLARK, ARTHUR J |

| CLARK, CLYDE I |

| CLARK, CONNIE L |

| CLARK, DAVID L |

| CLARK, DAVID W |

| CLARK, FRANCIS |

| CLARK, KENNETH E |

| CLARK, KLOSS DORIANNE |

| CLARK, RANDALL E |

| CLARK, ROGER D |

| CLARK, SCOTT |

| CLARK, SIDNEY M |

| CLARK, TAYLOR K |

| CLARK, TIMOTHY M |

| CLARK, TRACEY B |

| CLARK, VALERIE A |

| CLARK, VERN F |

| CLARKE, BRADLEY J |

| CLARKIN, JUSTIN R |

| CLASBY, KENNETH |

| CLASON, LINDSEY P |

| CLASPELL, LAURA |

| CLAWSON, CARLA |

| CLAYCOMB, MARILYN |

| CLAYCOMB, PETE |

| CLELAND, JAYLEEN D |

| CLEMENS, SCOTT M |

| CLEMENT, ARTHUR L |

| CLEMENT, ARTHUR W |

| CLEMENT, C EJR |

| CLEMENT-DIAZ, W P |

| CLEMENTI, BARBARA |

| CLEMENTI, SAMUEL J |

| CLEMMENSEN, CHERYL |

| CLEMMENSEN, JAMES C |

| CLEMMENSEN, WAYNE |

| CLENNIN, JAMES |

| CLENNIN, JANICE |

| CLENNIN, LINDA L |

| CLENNIN, ROY E |

| CLERMONT, ADELE |

| CLERMONT, ADELE S |

| CLIFFORD, HARRY |

| CLINGAN, R WSR |

| CLINK, GEORGE L |

| CLUCK, RONNIE |

| CO BANK & TRUST CO OF LA JUNTA |

| CO HO A GENERAL PARTNER |

| COBLER, PAULINE C |

| COBO, LARRY |

| COCA, ADRIAN JR |

| COCA, ARIANA C |

| COCA, RICHARD R |

| COCHRAN, ROBERT E |

| COCHRAN, SHELBY R |

| COCHRAN, ZACHARY R |

| COCKRUM, TROY W |

| CODER, TERESA E |

| CODINA, ARTHUR A |

| CODY, PATRICK J |

| COE, SHARON |

| COFFEE, JOE A |

| COFFEY, CHARLES |

| COFFEY, EDWIN |

| COGNINA, ELLEN F |

| COHEN, SANFORD |

| COKE, GLORIA J |

| COKELEY, TEX |

| COKER, EARL |

| COKER, JAMES E |

| COLANDER, RICHARD E |

| COLBERT, JORDAN S |

| COLBEY, EARL N |

| COLBY, MARK A |

| COLE, EUGENE A |

| COLE, JAMES R |

| COLE, JOSHUA |

| COLEBURN, JENNIFER M |

| COLEMAN, CHARLES M |

| COLEMAN, JACK W |

| COLEMAN, JOHN T |

| COLEMAN, TOMAS |

| COLINABARCA, GIOVANNY S |

| COLISTRO, BARBARA |

| COLLINS, ALBERT E |

| COLLINS, CODY R |

| COLLINS, EMOGENE G |

| COLLINS, EUGENE A |

| COLLINS, GLENN |

| COLLINS, JOHN E |

| COLLINS, JOHN N |

| COLLINS, LEO P |

| COLLINS, MARTHA |

| COLLINS, PATRICIA |

| COLLINS, VENITA |

| COLLINSWORTH, JAMES B |

| COLNAR, FRANK |

| COLNAR, JEFF |

| COLNAR, JEFFREY D |

| COLO NATIONAL BANK-BELMONT |

| COLOMA, JEANNEMARIE Y |

| COLONIAL ENTERPRISES INC |

| COLORADO CITY CONOCO |

| COLORADO CITY POST OFFICE |

| COLORADO INNOVATIVE CONTRACTOR |

| COLORADO INTERSTATE GAS |

| COLORADO LEAF LLC |

| COLORADO MUSEUM |

| COLORADO RESEARCH LAB |

| COLORADO STATE OF |

| COLORADO STATE PATROL |

| COLTER, GREG |

| COLUMBIA HOUSE RECORDS |

| COMBES, CAROL |

| COMBES, LUCINDA |

| COMBES, LUCINDA L |

| COMBS, CATRINA J |

| COMBS, KEVIN P |

| COMBS, STEVE |

| COMER, ADRIAN |

| COMFORT, JAYDE L |

| COMMUNITY, CHURCH |

| COMPARONI, HELEN M |

| COMPTON, GAVIN T |

| COMPTON, LOIS |

| COMPTON, W J |

| COMSTOCK, RICKY L |

| CONAWAY, CARSON H |

| CONAWAY, VIVIAN |

| CONCEPT 80 REAL ESTATE |

| CONCINI, AUDREY M |

| CONDER, JANICE |

| CONDER, PAUL |

| CONERLY, HARRY W |

| CONGLETON, JONI |

| CONKEL, JOHN |

| CONKLIN, DEANNA J |

| CONLEY, JANET |

| CONN, ALEX |

| CONN, TRUDY D |

| CONNELL, RANCH |

| CONNELL, WEAVER |

| CONNER, J A |

| CONNICK, RICHARD G |

| CONQUIST, SHARLA |

| CONRAD, LARRY J |

| CONRAD, NANCY M |

| CONTE, ANTHONY |

| CONTE, VICTORIA |

| CONTINENTAL BUILDERS |

| CONWAY, WILLIAM L |

| COODY, J W |

| COOK, DARRELL D |

| COOK, GENE E |

| COOK, JAMES O |

| COOK, JEFFREY |

| COOK, KIMBERLY J |

| COOK, MARY J |

| COOK, ROBERT L |

| COOK, ROBERT S |

| COOK, RONALD D |

| COOK, STUART L |

| COOK, WILLIAM |

| COOKE, CARA L |

| COOLAHAN, PARRIS |

| COOPER, AUSTIN E |

| COOPER, CHARLES R |

| COOPER, KAMI L |

| COOPER, KRISTI M |

| COOPER, PREMITIVA D |

| COOPER, SAMUEL |

| COOPER, SARA |

| COOPER, WILLIAM A |

| COOPER, WILLIE L |

| COPE, STANLEY L |

| COPELAND, CHARLES K |

| COPELAND, MAGNOLIA |

| CORBETT, HENRY F |

| CORBIN, J H |

| CORBIN, RICHARD E |

| CORCORAN, ROBERT J |

| CORDOVA, ABE |

| CORDOVA, ANN |

| CORDOVA, CELIA |

| CORDOVA, CHERI L |

| CORDOVA, DANIEL R |

| CORDOVA, DIANE R |

| CORDOVA, DONALD E |

| CORDOVA, FRANK B |

| CORDOVA, GEORGE I |

| CORDOVA, HELEN |

| CORDOVA, JENNIE |

| CORDOVA, JOHN R |

| CORDOVA, KENNETH R |

| CORDOVA, LENA R |

| CORDOVA, LOUIE J |

| CORDOVA, LUCINDA K |

| CORDOVA, MANUEL |

| CORDOVA, NATALIE B |

| CORDOVA, PAUL |

| CORDOVA, SHERRY A |

| CORDOVA, THERESA |

| CORDOVA, TONY |

| CORIAN, MATT |

| CORKLE, MARILYN |

| CORNELISON, H D |

| CORNELISON, RUTH L |

| CORNELIUS, JEB A |

| CORNELSON, NICOLE M |

| CORNERS, DINER |

| CORRAL, BRENDA S |

| CORRAL, FARMS |

| CORRAL, JOSE |

| CORRAL, LEO |

| CORSENTINO DAIRY FARM |

| CORSENTINO, DELPHINE |

| CORSENTINO, JESSICA N |

| CORSENTINO, JOE C |

| CORSENTINO, MARK A |

| CORSENTINO, NATHAN P |

| CORSO, ALBERT |

| CORTESE, DAVID |

| CORTESE, SAMUEL J |

| CORTEZ, BERNICE |

| CORTEZ, KEVIN M |

| CORTEZ, WENDY |

| CORTY, ROBERT J |

| COSBY, MICHELLE L |

| COSPER, VERENE |

| COSTANZA, LISA D |

| COSTELLO, ELIZABETH A |

| COSTELLO, TONY |

| COTE, RALPH |

| COTRINO, VERA |

| COTTER LAND & CATTLE CO |

| COTTRELL, COOTER DONNA |

| COTTRELL, KENNETH |

| COUCH, DONNA L |

| COUCHMAN, CLYDE L |

| COUNTRY ACRES KOA |

| COUNTZ, JOHN W |

| COURNS, JANEL L |

| COVEY, JESS N |

| COVEY, JOSH E |

| COVINGTON, CONSTANCE |

| COVINGTON, DAVID C |

| COVINGTON, SCOTT |

| COWAN, JAMES G |

| COWAN, JAMES W |

| COWGER, HOMER |

| COX, DAVID |

| COX, DONALD |

| COX, GAYLE |

| COX, GENE |

| COX, HENRY L |

| COX, KYLER E |

| COX, NEIL |

| COX, RICHARD |

| COX, SHARON L |

| COX, SHEILA F |

| COYLE, AMELIA |

| COYLE, BESSIE J |

| COYOTE CREEK CAPITAL CASH BAL P |

| COZ, EMMA |

| COZZI, CHARLIE |

| CRABB, TONY |

| CRABTREE, DICK |

| CRABTREE, MORGAN D |

| CRACAUER, RAY F |

| CRADDOCK, DORIS J |

| CRAFT, RONALD K |

| CRAGO, ROBERT |

| CRAIG, CLARK F |

| CRAIG, JAMES |

| CRAIG, JESSICA M |

| CRAIG, TAMMY |

| CRAIN, PEARL E |

| CRAMER, ALLAN B |

| CRAMER, ALLAN M |

| CRANE, PATRICIA E |

| CRANE, ROBERT L |

| CRANK, FILLMORE PJR |

| CRANMER, TERRY L |

| CRAPEAU, KIMBERLY A |

| CRASK, DOROTHY SR |

| CRASK, HERBERT G |

| CRAVER, KENNETH E |

| CRAWFORD, COMER |

| CRAWFORD, GORDON R |

| CRAWFORD, J F |

| CRAWFORD, JAMES F |

| CRAWFORD, PHYLLIS R |

| CRAWFORD, RANCH |

| CRAWFORD, ROYCE L |

| CREECH, JAMES M |

| CRESCENT, MOTEL |

| CRESS, THOMAS A |

| CREWS, NAPOLEON |

| CRIBBS, WILLIAM D |

| CRINO, LORETTA L |

| CRIPPEN, DOUGLAS |

| CRISP, CHRISTINA E |

| CRIST, MAX |

| CRITCHETT, MARY E |

| CRITZER, RAY D |

| CROCFER, MARTHA |

| CROCKER, CASSANDRA L |

| CROCKETT, CHARLENE L |

| CROCKETT, LIORAH |

| CROCKETT, TESSA |

| CROCKETT, ZACK B |

| CROFT, DONALD C |

| CROLEY, BILL L |

| CRON, MARVIN W |

| CROOK, BRIAN A |

| CROSS, JO |

| CROSS, L FLATS |

| CROSS, TODD |

| CROSSGROVE, LARRY B |

| CROSSLAND, BARBARA |

| CROSSON, DEAVON W |

| CROUCH, DEE B |

| CROUCH, JOHN W |

| CROUCH, TIMOTHY P |

| CROW, D M |

| CROW, MARY E |

| CROWBRIDGE, MICHAEL |

| CROWDER, JOSHUA R |

| CROWE PROPERTY |

| CROWELL, W E |

| CROWLEY, AARON |

| CROY, JOSH |

| CRULL, PAMELA L |

| CRUM, ANNE M |

| CRUM, JASON |

| CRUMP, ANN |

| CRUMP, JOHN |

| CRUMP, JOHN L |

| CRUMP, WILLIAM J |

| CRUPPI, KASSANDRA D |

| CRUZ, ANTHONY |

| CRUZ, ARTHUR L |

| CRUZ, BRENT A |

| CRUZ, BRONSON |

| CRUZ, FELIPE S |

| CRUZ, GUY |

| CRUZ, HEATHER M |

| CRUZ, HENRY E |

| CRUZ, JORDAN J |

| CRUZ, JULIO SR |

| CRUZ, PAT |

| CS WIND AMERICA INC |

| CUCHARA CHALET |

| CUCHARA CHRISTIAN FELLOWSHIP |

| CUCHARA VALLEY FURNITURE |

| CUCHARA VALLEY INS AGENCY |

| CUCHARA VALLEY LIQUOR |

| CUCHARA VALLEY MINI STORAGE LLC |

| CUCHARA VALLEY RESORT |

| CUCHARA VALLEY SKI RESORT |

| CUCHARES, VIRGINIA |

| CUCHIARA, CHARLES R |

| CUDE, HERSHEL D |

| CUDE, PATRICK J |

| CUEVAS, JOHN C |

| CULBREATH, GREGORY M |

| CULBREATH, MARY E |

| CULEBRA MOUNTAIN RANCH |

| CULLEN, JOHN R |

| CULLEN, SCOTT A |

| CUMBIE, KELLEY K |

| CUMMINGS, BOBBIE K |

| CUMMINGS, CAMERON J |

| CUMMINGS, L A |

| CUMMINGS, LA VAUGHN A |

| CUMMINGS, MARY B |

| CUMMINGS, SHARON S |

| CUMMINS, TOM E |

| CUN, HOP C |

| CUNEO, DIANA C |

| CUNICO'S RENTALS |

| CUNNINGHAM, STACEY J |

| CUPP, JERRY F |

| CUPP, TIMOTHY SR |

| CUPPS, ARIANA E |

| CURCIO, STEPHEN J |

| CURRIE, ELLA M |

| CURRIE, STACEY |

| CURRO, BUDDIE |

| CURRY, MARK S |

| CURTIS, KIMBERLEY L |

| CURTIS, ROBERT D |

| CURTIS, WILLIAM B |

| CUSHING, MIKAELA |

| CUSIMANO, LOUIS |

| CUSTER, A L |

| CUSTOM CABLE VENTURE OF COLO |

| CUSTOM UPHOLSTERY SHOP |

| CUTTS, WILLIAM D |

| CUZZETTO, TRINA S |

| CWIK, DANIEL P |

| D AND H RENTALS |

| D D AND D PARTNERS |

| DABOVICH, TAYLOR |

| DAGEFORDE, JEANNE M |

| DAGNILLO, FRANK |

| DAHER, HAISSAM A |

| DAHER, MOSE |

| DAHLBERG, ROBERT |

| DAHLSTROM, DAVID A |

| DAILING, DELBERT |

| DAILING, G C |

| DALE, CHANDLER |

| DALE, VIRGIL A |

| DALEY, JOHN W |

| DALHART COCA-COLA/CCE SHARED |

| DALLAFIOR, ANN |

| DALLAFIOR, LOUIS D |

| DALRICK, ANGIE |

| DALTON, ANNETTE W |

| DALTON, IVAN D |

| DALTON, JEFF R |

| DALY, SUSAN E |

| D'AMBROSIA, BELINDA S |

| D'AMBROSIO, PHILIP |

| DAMON, TYLER C |

| DANIEL, ROBERT R |

| DANIELS, JEANNINE L |

| DANIELS, MELISSA |

| DANIELS, PAUL K |

| DANIELS, ROBERT J |

| DANIELSON, KEN R |

| DANILLA, ANDREW |

| DANS, PROCESSING |

| DARCEY, THOMAS J |

| DARDANES, JIM |

| DARNALL, CHRISTY |

| DARNELL, J W |

| DARROW, CLIFFORD |

| DARVANIAN, MACHELLE |

| DASENBROCK, LAWRENCE J |

| DAUENHAUER, SHARON M |

| DAUGHERTY, EWONA |

| DAUGHERTY, ROBERT GJR |

| DAVENPORT, BRADEY T |

| DAVENPORT, KRISTY |

| DAVENPORT, LAWERENCE W |

| DAVID, DOMINIC J |

| DAVID, SAM |

| DAViDOVICH, GEORGE R |

| DAVIDSON, C C |

| DAVIDSON, ELSIE A |

| DAVIDSON, JOHN MII |

| DAVIDSON, JUDSUN |

| DAVIES, H L |

| DAVIES, MERLE V |

| DAVIS, AARON |

| DAVIS, BRUCE A |

| DAVIS, BURNIE |

| DAVIS, C GAYE |

| DAVIS, CAROLYN A |

| DAVIS, CECIL C |

| DAVIS, CLAUDIA G |

| DAVIS, DENISE M |

| DAVIS, DIXIE D |

| DAVIS, DONNA |

| DAVIS, EUGENE |

| DAVIS, GERTRUDE |

| DAVIS, GLENN R |

| DAVIS, HOPE E |

| DAVIS, ILDA |

| DAVIS, JACK |

| DAVIS, JUDITH |

| DAVIS, K R |

| DAVIS, LESLIE E |

| DAVIS, MARK |

| DAVIS, MELVIN |

| DAVIS, MICHELLE |

| DAVIS, NORMA S |

| DAVIS, RICHARD B |

| DAVIS, ROBERT LSR |

| DAVIS, RODNEY |

| DAVIS, TAYLOR |

| DAVIS, WILLIAM T |

| DAVIS, WILLIAM W |

| DAVISON, DELBERT |

| DAVISON, EARLE |

| DAWDY, JEFF |

| DAWES, MARGARET H |

| DAWSON, BRAD |

| DAWSON, CECIL L |

| DAWSON, DAWN R |

| DAWSON, ROBERT D |

| DAWSON, ZACHARY C |

| DAY, CASEY K |

| DAY, KENNETH |

| DAY, MARCI A |

| DAY, MARTIN S |

| DAYS INN |

| DAYTON, MONA W |

| DE AGUERO, FELIX |

| DE BONO, CATHERINE P |

| DE CRISTINO, MIKE |

| DE CRISTINO, RICHARD |

| DE FELLIPO, CANDICE |

| DE FIELD, DIANE M |

| DE GARBO, JEANINE E |

| DE GARBO, JIM |

| DE GARBO, JIMMIE |

| DE GARBO, JOEY V |

| DE GRADO, ERIC |

| DE HEART, CHARLES H |

| DE HERRERA, BENEDICTA E |

| DE HERRERA, EUGENE |

| DE HERRERA,EVA |

| DE HERRERA,JAMES A |

| DE HERRERA, MANUEL F |

| DE HERRERA, MEL JR |

| DE HERRERA, ORESS J |

| DE HERRERA, RAMON |

| DE ISLA, LEON F |

| DE JOY, VALERIE |

| DE KINS, SCOTT |

| DE LA ROSA, ROBERT |

| DE LANCEY, CHARLES J |

| DE LAP, KENNETH W |

| DE LE CRUZ, LEONARDO |

| DE LEON, ELARIA |

| DE LIMA, LOUIS A |

| DE LUCA, DEBBIE |

| DE MARTINE, ANTHONY JR |

| DE MENT, JULIE A |

| DE SANTIS, SAM |

| DE SHIELDS, H W |

| DE TRAY, KIMBERLY |

| DE VOLIN, W G |

| DE VORE, LEONARD |

| DE WITT, BILL K |

| DEAN-HUTCHINSON ENTERPRISES |

| DEAR, BILLY |

| DEARCOS, ANGEL L |

| DEAVER, JOHN T |

| DEBES, JACQUELYN A |

| DEBORD, SHANNON M |

| DECKER, CHARLES D |

| DECKER, SANDY |

| DECOUD, PHILLIP A |

| DECRISTINO, ROBERT |

| DEDIO, NICHOLAS |

| DEERPRINT, WINE |

| DEES, AGNES G |

| DEFRANK, DANA L |

| DEGANI, JOSEPH J |

| DEGENER, DAVID A |

| DEGENNARO, JESSE D |

| DEGURSE, WALTER |

| DEHARO, BROWN MORGAN |

| DEHERRERA, CHERYL L |

| DEHERRERA, MARIO A |

| DEIGHTON, HAROLD G |

| DEITRICK, DANIEL J |

| DEITZ, MARTHA J |

| DELACRUZ, VERONICA |

| DELANEY, FRANKI B |

| DELANY, SHEA L |

| DELEON, CHRISTINE A |

| DELEON, DAYLENE |

| DELERME, FELIX |

| DELGADO, CARLOTTA |

| DELGADO, DENISE R |

| DELGADO, WILLIAM |

| DELL, TONY P |

| DELLING, MARCELLA D |

| DELMAS, REX |

| DELONG, JOSHUA M |

| DEMEL, ROBERT |

| DEMONT, PATRICK M |

| DEMPSEY, JEANIE M |

| DEMUTH, AMBER N |

| DENHAM, CHRIS T |

| DENNING, GALEN |

| DENNIS, LESTER |

| DENNIS, WALTER D |

| DENNIS, WILLIAM L |

| DENOVA, ARMANDO R |

| DENT, SHONNA B |

| DENTAN, JOLEEN |

| DENTON, CLARINE |

| DENTON INS AGENCY |

| DENZER, FRANK |

| DEPUE, PAMELA M |

| DERINGER, ASHLEY M |

| DERINGTON, TERRY L |

| DERNOVSHEK, ANNA |

| DERRICK MOTEL |

| DESERT REEF LLC |

| DESERT SKY HOMES |

| DEULEN, CINDY M |

| DEULEN, MICHAEL T |

| DEUTSCHER, ALFRED SR |

| DEVAN, VERONICA J |

| DEVELOPERS DIVERSIFIED |

| DEVENPORT, MARY |

| DEVERAUX, BRUCE |

| DEVERICH, MICHAEL L |

| DEWEY, TRACI L |

| DEWITT, VANESSA |

| DEYNE, DENNIS |

| DHATT, YASHWANT S |

| DI, BENEDETTI BRIAN |

| DI, GREGORIO JULIUS |

| DI, MATTEO MARIO J |

| DI, SALVO VIOLA |

| DI, SANTI RUSSELL E |

| DIAL, BILL B |

| DIANDA, CASIMIRO |

| DIAZ, BREANA |

| DIAZ, CELESTINO P |

| DIAZ, CHRISTOPHER |

| DIAZ, CLIFFORD A |

| DIAZ-GARCIA, TINA J |

| DICK, CHARLES J |

| DICK FEDERICO TRUST |

| DICK, GEORGE D |

| DICKERHOOF, ROBERT A |

| DICKINSON, DEAN L |

| DIDERO, JOHN A |

| DIEHL, FLORENCE |

| DIERKS, MICHAEL E |

| DIETRICH, JOHN R |

| DIETRICK, WILLIAM R |

| DIETZ, HARRY |

| DILDA, TOMMY |

| DILLAHA, TORY L |

| DILLER, ROGER K |

| DILLON, CHARLET E |

| DILLON, LAURA A |

| DILLON, RACHEL |

| DIMMER, RABECCA E |

| DINGLE, ROBERT WMD |

| DINGMAN, HELGA M |

| DINKEL, FRANK W |

| DINNERSTEIN, MARC |

| DINWIDDIE, DANIEL J |

| DIONISIO, DEBRA L |

| DIRK, TED E |

| DIRRIM, DAVID |

| DISHAROON, WENDY S |

| DITTMAR, RICHARD E |

| DIVALE, LORCA |

| DIXON, HEATHER |

| DIXON, VICTORIA B |

| DKC LLC |

| DLM CONSTRUCTION |

| DO RAY LAMP CO INC |

| DOBBS, ROBERTA J |

| DOCHTER, KENNETH |

| DOCKTER, MICHAEL |

| DODGE, JASON |

| DODGE, L D |

| DODIES, INC |

| DODSON, JOE R |

| DOERR, CARLA F |

| DOHERTY, JAMES J |

| DOHERTY, JENNIE |

| DOHERTY, SUZANNA M |

| DOIEL, DONALD R |

| DOLAK, R T |

| DOLCE, AUDIE L |

| DOLDER, PAUL |

| DOLL, ROBERT E |

| DOLZANIE, DOROTHY M |

| DOMANGUE, THOMAS K |

| DOMER, MARION F |

| DOMINA, BOB |

| DOMINA, SAM |

| DOMINGUEZ, ART A |

| DOMINGUEZ, JOSE |

| DOMINGUEZ, NANCY |

| DOMINGUEZ, RUEBEN |

| DOMINIAK, DANIEL |

| DON K RANCH |

| DONAGHE, DAN |

| DONATELL, CECELIA L |

| DONATO, RICO |

| DONEY, SHEILA R |

| DONLEY, FORREST |

| DONLEY, H T |

| DONLEY, HELEN L |

| DONLEY, MARY E |

| DONLON, WILLIAM |

| DONNELL, DAVID S |

| DONNER, CHRISTIAN T |

| DONOHOE, JEFF |

| DORE, DANIEL P |

| DOROTHY HOAG RAWLINGS BEULAH TR |

| DORROUGH, TAMRA |

| DOSEN, BARBARA J |

| DOSEN, MIKE |

| DOTSON, DAN |

| DOTSON, DAWN E |

| DOTSON, FREDIE D |

| DOUB, AARON N |

| DOUD, MICHAEL T |

| DOUGHTY, DAVID L |

| DOUGLASS, CHRIS R |

| DOUGLASS, ROBERT J |

| DOVER, D J |

| DOVER, GORDON |

| DOVGAN, SAMO |

| DOVGAN, SETH J |

| DOWD, LARRY L |

| DOWEN, LEONARD |

| DOWLING, AARON D |

| DOWNEY, JOHN L |

| DOWNEY, MARSHALL E |

| DOWNING, GRISELDA P |

| DOWNS, H W |

| DOWNS, JOHN M |

| DOWNTOWN TRAILER COURT 87-98 |

| DOWNTOWN TRAILER COURT 98-2010 |

| DOYEN, CHRISTY J |

| DOYLE, EDMOND T |

| DRAKE, PATRICIA A |

| DRAPEAU, DEBORAH S |

| DRAWDEL LAND & CATTLE CO INC |

| DRAY, LARRY L |

| DRAY, SUSAN J |

| DREAM, EAGLE DAWN D |

| DREILING, PATTY |

| DRESSEL, DENVER K |

| DRESSEL, KEITH R |

| DRESSLER, KRISSTOFUR P |

| DRESSLER, MARIDITH |

| DREW, GEORGE |

| DREXLER, DENISE |

| DRIESEL, C K |

| DRISCOLL, DAN |

| DRISCOLL, MELANIE J |

| DRISKILL, SAMUEL D |

| DRIVER, WILLIAM C |

| DROSSOS, ANGELO |

| DRUM, ALBERT J |

| DRUM, KAREN |

| DRUM, KAREN L |

| DRUMMOND, SCOTT K |

| DRURY, BOB |

| DRURY, GINA S |

| DRY CREEK RANCH |

| DRY, PHILLIP O |

| DRYDEN, HELEN J |

| DU, FUR NORMAN |

| DUBBEL, DUANE |

| DUBOIS, ALFRED M |

| DUCKSWORTH, ALEXANDER |

| DUDLEY, TIMOTHY EMD |

| DUELL, HOLLAND |

| DUELL, MARY H |

| DUENEZ, MIGUEL A |

| DUFFY, J E |

| DUFTY, ALAN S |

| DUFUR, VERN |

| DUGAN, BUZZIE OR |

| DUHON, DEA A |

| DUKE, NORMAN C |

| DUNAWAY, LEOTA |

| DUNAWAY, LEOTA B |

| DUNCAN, DONALD B |

| DUNCAN, DONNIE R |

| DUNCAN, GLENNA |

| DUNCAN, HANNAH E |

| DUNCAN, M B |

| DUNCAN, NANCY |

| DUNFORD, BEATRICE |

| DUNFORD, JIM C |

| DUNGAN, EDNA M |

| DUNGY, LYLE WSR |

| DUNKIN, CATHERINE I |

| DUNLAP, ELIZABETH |

| DUNMORE, WILLIAM |

| DUNN, ELIZABETH A |

| DUNN, JIM |

| DUNN, KATHERINE A |

| DUNN, KEVIN P |

| DUNN, TIMOTHY H |

| DUNN, WILLIAM E |

| DUNNE, HELEN |

| DUNNING, KENT P |

| DUNNINGTON, DARRYL |

| DUNTON, SHAE |

| DUPLER, RONALD L |

| DURAN, ANDREW |

| DURAN, ANGELA M |

| DURAN, AURORA |

| DURAN, BERNADETTE |

| DURAN, CORNELIUS |

| DURAN, CRYSTAL I |

| DURAN, DOROTEO |

| DURAN, ELENA |

| DURAN, ELIZABETH M |

| DURAN, ERNESTINE |

| DURAN, GERALD J |

| DURAN, GILBERT L |

| DURAN, JENNIE |

| DURAN, JOANN M |

| DURAN, JOE D |

| DURAN, LEE |

| DURAN, MANUAL |

| DURAN, MARY |

| DURAN, MATTHEW |

| DURAN, MEGAN L |

| DURAN, MELVIN |

| DURAN, MONTANA E |

| DURAN, ROSE |

| DURAN, XANDER |

| DURANS, RODEO RANCH |

| DURHAM, JOANNA E |

| DURKIN, JORGE |

| DURKIN, KENNETH |

| DURNER, STEPHEN |

| DURRETT, JERRY D |

| DURRUM, MARGI |

| DUSKEY, BRIAN K |

| DUSSART, GEORGE |

| DUSTIN, FREDERICK W |

| DUSTON, STACEY |

| DUZENACK, CLIFFORD W |

| DUZENACK, FRANK A |

| DWORZACK, SARAH |

| DWYER, DALLAS M |

| DYE, J D |

| DYE, NEAL |

| DYE, ROBERT G |

| DYKE, TRACY J |

| DYKMAN, RHONDA L |

| EAGLE, LORENA |

| EAGLE RIVER |

| EARL, DAVID |

| EARL WATER USERS ASSN |

| EARNHARDT, DEBRA S |

| EAST, DANIEL |

| EAST FIFTH INVESTMENT LLC |

| EAST PEAK ENTERPRISES |

| EASTON, DOUG M |

| EASTON, TRACEE |

| EBELL, ALISA |

| EBERLY, LEAANN K |

| EBIE, DANIEL E |

| ECCHER, DENAE E |

| ECCHER, SALAZAR AUSTIN J |

| ECCLES, DUSTON T |

| ECHO CANYON OUTFITTERS |

| ECK, LEWIS |

| ED ONE SOLUTIONS |

| EDDLEMAN, TODD P |

| EDDY, FARON A |

| EDEN, BRONTE R |

| EDGERTON, JOANNE M |

| EDMINSTER, JAMES W |

| EDMONDS, DENNIS E |

| EDMUNDSON, VIRGINIA H |

| EDWARDS, BARBARA H |

| EDWARDS, BEN T |

| EDWARDS, BERTHA |

| EDWARDS, BETHA F |

| EDWARDS, DAVID L |

| EDWARDS, FLOYD |

| EDWARDS, JESSIE J |

| EDWARDS, RAY |

| EDWARDS, ROBERT F |

| EDWARDS, ROBERT L |

| EDWARDS, SYBIL |

| EGAN, JOHN P |

| EGGERING, GREG |

| EHART, DAKOTA D |

| EHART, VICTORIA |

| EHLERS, JOEL P |

| EHMAN, WM R |

| EHRLICH, KATHY L |

| EICHENBERGER, BETTY |

| EIDE, HELMEKE |

| EIDSON, LONNIE |

| EIDSON, MARK H |

| EISENBEIS, H R |

| ELARTON, ELDON R |

| ELDER, J FMD |

| ELICH, PETER A |

| ELIM, FULL GOSPEL |

| ELISALDE, MARQUITA B |

| ELISHA, THERESA I |

| ELIZABETH, BULTHUIS |

| ELKINS, WILLIAM L |

| ELLEY, MAX |

| ELLIOT, NEIL W |

| ELLIS, HAROLD |

| ELLIS, NICK |

| ELLIS, PATRICK H |

| ELLIS, RICHARD |

| ELLISON, GORDON |

| ELLISON, MARY |

| ELLISON, VERNON CJR |

| ELLMAN, M |

| ELLSWORTH, J C |

| ELWELL, BETTY |

| ELWELL, CRAIG J |

| ELWELL-BRYAN, SUE A |

| ELY, EVELYN S |

| EMANUEL, WILLIAM A |

| EMBREE, JORDAN M |

| EMDE, LOUIS L |

| EMERSON, JERRY K |

| EMERY, DENNIS R |

| EMERY, HOWARD |

| EMORY, ALAN |

| ENCINIAS, EUGENE |

| ENCINIAS, KAYLA R |

| ENCINIAS, MANUEL |

| ENDERUD, LARRY |

| ENGLAND, LORY |

| ENGLISHBEE, ERNEST W |

| ENNS, PHIL C |

| ENOCHS, LINDA B |

| ENOS, MARK A |

| ENRICH, ALLAN |

| ENRICH, ROBERT F |

| ENRIETTI, ANTHONY |

| ENRIQUEZ, DAWN C |

| EPPLY, SUSAN |

| EPPS, JOHN A |

| ERA CONCEPT 80 REAL ESTATE |

| ERFURDT, VALERIE B |

| ERICKSON, EDWARD |

| ERICKSON, LON E |

| ERIKSON, GARY |

| ERKSEN, ELDON |

| ERMEL, BRAD |

| ERNST, ROBERT R |

| ERSKINE, JENNIFER L |

| ERWIN, MARGARET M |

| ERZEN, ROBERT J |

| ESAU, IVAN |

| ESCALANTE, VIOLA |

| ESCONTRIAS, CHRISTIAN A |

| ESGAR, PATRICIA |

| ESPINOZA, ABEDON |

| ESPINOZA, DANNY R |

| ESPINOZA, DULCINELLA |

| ESPINOZA, FAITH V |

| ESPINOZA, KENNETH |

| ESPINOZA, KENNETH R |

| ESQUIBEL, JEAN R |

| ESQUIBEL, MARY R |

| ESQUIBEL, NICHOLE A |

| ESQUIVIAS, JOSE A |

| ESSMEIER, ROY R |

| ESTATE OF DONALD MINERICH |

| ESTATE OF ERIC B BACHMAN |

| ESTATE OF LOUIS A CERESNAK |

| ESTATE OF RENA KAPLOWITZ |

| ESTATE OF RICHARD M O'ROURKE |

| ESTES, COLLEEN A |

| ESTES, DEBRA K |

| ESTES, JAMES A |

| ESTES, KERSTIN H |

| ESTHER'S, PLACE |

| ESTRADA, BRIAN D |

| ESTRADA, DANIEL A |

| ESTRADA, NANCY |

| ETHRIDGE, DAVID |

| EUMONT, HARRY WJR |

| EURICH, PATRICIA D |

| EVANS, BILL |

| EVANS, DANIEL L |

| EVANS, ERMA |

| EVANS, LISA E |

| EVANS, LOYD SR |

| EVANS, ROBERT C |

| EVANS, THOMAS H |

| EVE, DYLAN |

| EVEN, EVERETT E |

| EVEN, NATHAN E |

| EVEN, WILLIAM C |

| EVENSEN, MARGARET |

| EVERHEART, BARBARA A |

| EVERS, EDWARD J |

| EVERSON, JAMES F |

| EVERT, MARK S |

| EWALD, MICHAEL H |

| EWALD, PAMELA L |

| EWART, HELEN |

| EWING, LONE K |

| EWING, PRESTON |

| EXBY, ROBERT |

| EZELL, RONALD |

| EZYK, STEVEN |

| F A R M INC |

| F B ROOKE & SONS |

| F H & W INC |

| FABER, JASON A |

| FADENRECHT, DARREN S |

| FAHMIE, PATRICK |

| FAITH CHRISTIAN FELLOWSHIP OF |

| FALAGRADY, BARNEY |

| FALAGRADY, FRED R |

| FALCONER, ROY |

| FALCONER, WM W |

| FALK, BROCK J |

| FALK, JAMES L |

| FALKENSTEIN, ELIZABETH |

| FALL, GARY |

| FALLETTA, PETE V |

| FALSETTO, JOE |

| FAMILY EYE CENTER |

| FAMILY FOOTWEAR |

| FANCHER, LARRY |

| FANCY, PANTS VARIETY |

| FANDRICH, LARRY |

| FANSLER, J R |

| FAR, WEST CATTLE CO |

| FARACE, PAUL J |

| FARBER-SHROUT, KAREN K |

| FARICY, TERESA M |

| FARIES, SIMON |

| FARIS, DANA B |

| FARIS, J R |

| FARIS, SUMMER |

| FARLEY, FRED M |

| FARLEY, THOMAS T |

| FARM CREDIT SERVICES |

| FARMER, THOMAS |

| FARMERS INSURANCE GROUP |

| FARNEY, RYAN C |

| FARNHAM, FLOYD R |

| FARNSWORTH, LINDA D |

| FARR, GERTRUDE |

| FARRAR, CAROLYN |

| FARRAR, CARROLL D |

| FARRELL, R G |

| FARREN, JAMES W |

| FARRIN, MARGE |

| FARRINGTON, JOHN T |

| FARRINGTON, TERESA |

| FASONE, VINCENT |

| FASS, LOUIS A |

| FAULK, GARY |

| FAULKNER, ELEESA K |

| FAULKNER, JEFFREY B |

| FAUROT, RAY |

| FAUST, LEONARD |

| FAWKES, GARY L |

| FAWKES, SUSAN |

| FEDERAL DEPOSIT INS CORP |

| FEHRING, STEVE J |

| FEISTER, DENNIS J |

| FELLER, MERLE |

| FELTHAGER, AMANDA L |

| FELTHAGER, JACK |

| FELTHAGER, SANTIAGO E |

| FELTON, DAIMION M |

| FELTS, JOHN D |

| FELTS, ROBERT E |

| FERGUS, STEVEN |

| FERGUSON, CLINTON D |

| FERGUSON, JAMES H |

| FERGUSON, JESSICA B |

| FERGUSON, JO E |

| FERGUSON, JOHN S |

| FERGUSON, SARA J |

| FERN, MARY E |

| FERNANDEZ, ABNER |

| FERNANDEZ, ALYSSA M |

| FERNANDEZ, JACLYNN N |

| FERNANDEZ, RUBEN |

| FERNANDEZ, SHERRY L |

| FERRARI, FALLON F |

| FERRARI, FRED IJR |

| FERRARI, NICHOLAS I |

| FERRARO, ARCHILLO L |

| FERRARO, EDDIE |

| FERRELL, DONALD |

| FERRENDELLI, LEAH |

| FERRERO DOZER SERVICE/LUCKY SER |

| FERRERO, MIKE A |

| FERRERO, TERESA |

| FERRI, FRANK SR |

| FETTY, KRIS |

| FIELD, MARILEE |

| FIELDS, ARTHUR M |

| FIELDS, FRANCES C |

| FIELDS, JOSHUA D |

| FIGAL, BARBARA |

| FIGAL, MARY A |

| FIKE, ETHEL L |

| FILANGI, JACQUELINA |

| FILER, D L |

| FILIPPO, JEFF E |

| FILLMORE, ANNA M |

| FILLMORE, EMILY S |

| FIMPLE, F B |

| FIN, & FEATHER CLUB |

| FINDLEY, WALTER E |

| FINE, CLIFF D |

| FINGERS, NANCY |

| FINK, HAROLD W |

| FINK, JACK |

| FINK, JOSHUA |

| FINLEY, DONALD D |

| FINLEY, MATTHEW |

| FINN, JAMES W |

| FINNEGAN, SEAN D |

| FIORENZI, MARGIE |

| FIREBAUGH, TYLER |

| FIRKINS, JULIA L |

| FIRM, DAVID J |

| FIRST BAPTIST CHURCH OF COLORAD |

| FIRST SOUTHERN BAPTIST CHURCH |

| FIRST STATE BANK |

| FISCHER, STUART J |

| FISH, HERBERT |

| FISHER, CHARLES H |

| FISHER, E C |

| FISHER, JOHN R |

| FISHER, LA QUETA |

| FISHER, MICHAEL J |

| FISHER, THOMAS A |

| FITZGERALD, MARK H |

| FITZGERALD, TAMMY L |

| FITZSIMMONS, CLAIR K |

| FJARE, PAUL S |

| FLANDERMEYER, WILLIAM D |

| FLANIGAN, JAMES D |

| FLASCHER, CYNTHIA L |

| FLECK, CHERYL K |

| FLEMING, MARY A |

| FLEMMER, HARLAND |

| FLERRY, CARLOTTA |

| FLETCHER, TABITHA L |

| FLICK, GERALDINE |

| FLICK, NANCY |

| FLINN, RICHARD E |

| FLINT, ALEXANDER H |

| FLINT, BETTY J |

| FLINT, CLARENCE |

| FLISAK, MARY |

| FLOOD, JACQUELINE |

| FLORES, ARTHUR D |

| FLORES, CHRISTIAN B |

| FLORES, JUAN C |

| FLORES, ROY |

| FLOREZ, IRENE V |

| FLORI, REBECCA |

| FLOROM, PEGGY A |

| FLORY, THERESA M |

| FLOT, ANN |

| FLOWERS, WESTON |

| FLYNN, CARROLL |

| FLYNN, LEANN |

| FOECHTERLE, KATI |

| FOGG, WILLIAM K |

| FOGLE, JACK E |

| FOLEY, DAN H |

| FOLEY, KENNY L |

| FOLSE, JANET C |

| FOOTE, CHARLENE |

| FORBES, DOUGLAS W |

| FORBES, LEE E |

| FORBES, MARGARET |

| FORBIDUSSI, VERA |

| FORD, ADAM J |

| FORD, HULEN L |

| FORD, JULIE A |

| FORD, MARK A |

| FORD, ROBERT W |

| FORD, STEVEN R |

| FORD, VICKI A |

| FORD, WM D |

| FOREMAN, BYRON L |

| FOREMAN, WILSON |

| FORGY, ROY D |

| FORNOF, MICHAEL D |

| FORSYTHE, DAKOTA G |

| FORSYTHE, DAWN M |

| FORTE, FREDERICK |

| FORTINE, DAVID E |

| FORTINO, CAROL |

| FOSE, BEN F |

| FOSS, MILDRED F |

| FOSSIER, DONNA J |

| FOSTER, GEORGE W |

| FOSTER, JAMES R |

| FOSTER, M B |

| FOSTER, RICHARD J |

| FOSTER, SANDRA |

| FOSTER, TRAVIS M |

| FOSTER, VIRGINIA K |

| FOUNDATIONS FOR THE FUTURE |

| FOUNTAIN, GEORGE J |

| FOUR A RESTAURANT |

| FOWLER, DYANN L |

| FOWLER, GORDON N |

| FOWLER, PIERCE |

| FOX, COLLIS CHARLES L |

| FOX, JASON R |

| FOX, JOYCE |

| FOX THEATRE WALSENBURG |

| FOX-FERGUSON, PATRICIA Y |

| FOX-RAGUINDIN, BRYCE J |

| FRABETH, INDUSTRIES INC |

| FRANCE, ELIZABETH D |

| FRANCISCOTTI, BEN |

| FRANCO, ANDRES A |

| FRANCO, GEORGE |

| FRANK, KARYL L |

| FRANK, PHILLIP |

| FRANK, POLANCO FAMILY LTD |

| FRANKLIN, DARREL K |

| FRANKLIN, DELLA T |

| FRANKLIN, KATHY |

| FRANKLIN, MALYNDA M |

| FRANSUA, MARK |

| FRANSUA, ROBERT |

| FRANTZ, FRANK |

| FRATTERELLI, ELIZABETH |

| FRAZEE, FRANCIS |

| FRAZER, CLARENCE A |

| FRAZIER, BEA |

| FRAZIER, DONALD J |

| FRAZIER, SUZIE |

| FRAZIER, TAYLOR J |

| FRAZZINI, RAY |

| FREDERIKSEN, JON L |

| FREDERIKSEN, KATHLEEN K |

| FREDRICKSON, DIRK D |

| FREDRICKSON, ERIC N |

| FREDRICKSON, KENNETH L |

| FRED'S, QUICK LUBE |

| FREDSELL, HAROLD F |

| FREEBORN, DAVID |

| FREEL, PAMELA J |

| FREEMAN, E W |

| FREEMAN, GREG |

| FREEMAN, HOWARD W |

| FREEMAN, ROBERT S |

| FREEMAN, RUDEE A |

| FREEMAN, WAYNE D |

| FREIER, LAWRENCE D |

| FREILINO, DAVID P |

| FRENCH, THOMAS |

| FRENCHMORE, SALLY |

| FRERICHS, MENNO G |

| FRESH AND CLEAN LAUNDROMAT |

| FRESQUEZ, PENNY |

| FREY, LESLIE |

| FRIEDRICH, KAREN A |

| FRIEL, JAMES |

| FRIEND, LINDA |

| FRIEND, RAY |

| FRIGGERI, ROBERT |

| FRINK, ANN |

| FRISBIE, CYNTHIA |

| FRITZSCHING, MICHAEL |

| FRONEK, ELIZABETH S |

| FRONEK, JAMES L |

| FRONTIER MOTEL OF TRINI |

| FROST, EDWIN J |

| FROST, ROBERT H |

| FRS ENTERPRISES LLC |

| FRY, BILL |

| FRYE, JOSEPH S |

| FUENTES, ALYSSA J |

| FUENTES, DARLENE |

| FUENTES, JEANNE |

| FUENTES, SERGIO |

| FUJITA, Y J |

| FULBRIGHT, SCOTT A |

| FULGENZI, LA DAWN |

| FULTON, DONALD L |

| FUNDERBURG, LEWIS R |

| FUNKE, EARL DSR |

| FUNKE, KARLA |

| FUQUA, VERNON D |

| FURBER, CAROLYN J |

| FURGESON, ERNIE E |

| FURPHY, OPAL |

| FURPHY-LAWSON, CHAPEL |

| FYNEWEVER, AARON J |

| G, & M DISTRIBUTOR |

| GABEL, JEFFREY |

| GABLE, MELVIN C |

| GADE, DON M |

| GAGLIARDI, GLORIA |

| GAILE, SANDRA K |

| GAINES, CHERYL |

| GAINES, MAX C |

| GALAMBOS, BRUCE |

| GALANIC, PATRICIA |

| GALASSO, ALBERT |

| GALASSO, ANTOINETTE B |

| GALLAGHER, MIKE E |

| GALLAGHER, WILLIAM |

| GALLANT, LARAE |

| GALLAWAY, H H |

| GALLEGOS, AMARANTE JR |

| GALLEGOS, ANASTACIO |

| GALLEGOS, CELINA |

| GALLEGOS, DAN J |

| GALLEGOS, KENNETH C |

| GALLEGOS, KEVIN |

| GALLEGOS, LUCILLE |

| GALLEGOS, MANUEL |

| GALLEGOS, MARY A |

| GALLEGOS, NAIOME R |

| GALLEGOS, RALPH |

| GALLEGOS, RUBY |

| GALLEGOS-BOUCHER, JENNIFER |

| GALLO, RODEO |

| GALLOWAY, STEVE |

| GALLOWAY, WILLIAM E |

| GALLUP, JOAN B |

| GALPIN, GLENDA |

| GALPIN, KIRBY D |

| GALUSHA, BETTY J |

| GALVAN, ELOY |

| GALVEZ, LOUIS |

| GAMBLE, BILLY G |

| GAMBLE, TED H |

| GAMBOA, MANUEL |

| GAMS, VALERIE |

| GANATTA, JO J |

| GANDARA, JOSE A |

| GANDARILLA, DOROTHY |

| GANDORA, JOSE A |

| GANDY, MABEL |

| GANT, JASON D |

| GANT, JOSEPH W |

| GARBER, M B |

| GARBISO, JANE |

| GARBIZO, FRANCES A |

| GARBIZO, HORACE |

| GARCIA, ADAM |

| GARCIA, ALBERT E |

| GARCIA, ANTHONY NSR |

| GARCIA, ART |

| GARCIA, BETTY |

| GARCIA, BRIANNA |

| GARCIA, CARLOS |

| GARCIA, CARMELLA J |

| GARCIA, CHARLES |

| GARCIA, CHARLIE L |

| GARCIA, CLARENCE A |

| GARCIA, CONNIE |

| GARCIA, CORINE |

| GARCIA, DEBBIE J |

| GARCIA, DEBORAH A |

| GARCIA, DONNIE R |

| GARCIA, EDGAR |

| GARCIA, EVA |

| GARCIA, EVANGELINE V |

| GARCIA, FELIX |

| GARCIA, GENE A |

| GARCIA, GILBERT |

| GARCIA, GILBERT JR |

| GARCIA, IRENE |

| GARCIA, JAKE F |

| GARCIA, JEFF W |

| GARCIA, JESSE D |

| GARCIA, JOHN A |

| GARCIA, JOHN E |

| GARCIA, JOHN R |

| GARCIA, JOSEPH S |

| GARCIA, JOYCE E |

| GARCIA, KENNETH |

| GARCIA, KIMBERLY E |

| GARCIA, LYDIA E |

| GARCIA, MANUEL |

| GARCIA, MICHELLE |

| GARCIA, MIKE A |

| GARCIA, PATRICK |

| GARCIA, PEGGY |

| GARCIA, PHILIP J |

| GARCIA, PRES |

| GARCIA, RAQUEL M |

| GARCIA, RAYMOND |

| GARCIA, RICK M |

| GARCIA, ROBERT T |